(Bloomberg) -- Advanced Micro Devices Inc. is gaining share in the lucrative market for server chips, the latest sign it’s benefiting from close ties to a major Taiwanese factory partner to win orders from larger rival Intel Corp. Shares surged in late trading.

Strides in server chips will help propel third-quarter revenue to about $2.55 billion, Santa Clara, California-based AMD said Tuesday, topping analysts’ average prediction for $2.3 billion. The company also raised full-year sales forecasts, and second-quarter results beat Wall Street expectations. AMD stock climbed as much as 11% in extended trading after closing at $67.61 in New York.

After decades of lagging behind Intel, AMD has been catching up in recent years, helped by advances at Taiwan Semiconductor Manufacturing Co., which makes chips on its behalf. Intel, by contrast, has suffered a series of manufacturing setbacks, last week saying it’s fallen behind in a new method for cutting-edge semiconductors and that it’s considering scrapping a decades-old strategy of making chips in-house.

The admissions sparked a selloff in Intel stock and underscored the ways Intel is being surpassed by TSMC, which in turn helps TSMC’s partners.

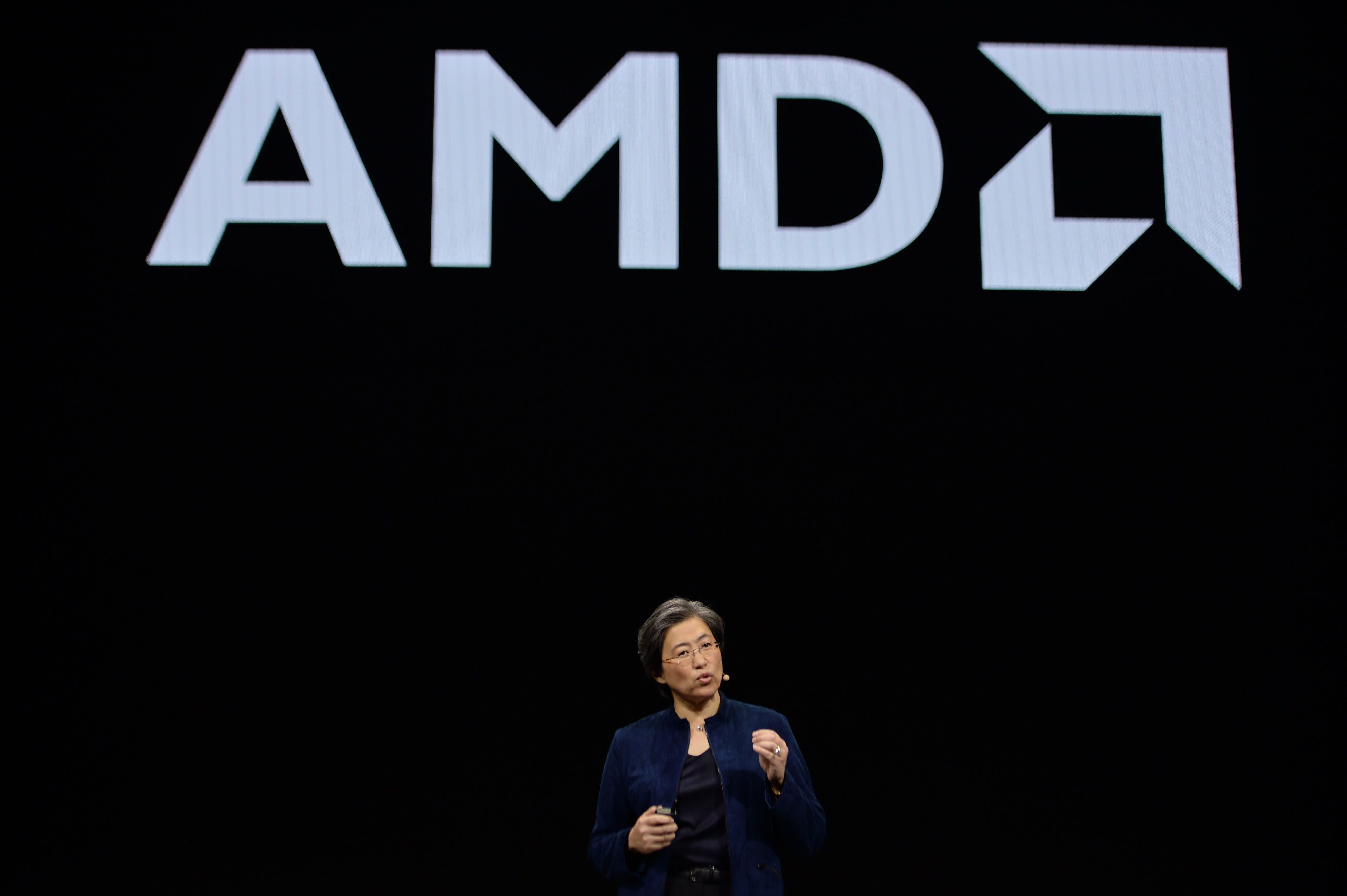

AMD Chief Executive Officer Lisa Su said her bullish outlook is based on expectations that her company will keep adding share as new products gain wider adoption at computer makers. She said AMD has passed 10% share of the profitable server chip market and that while supply of leading-edge chips is “tight,” the company is confident it can meet increasing demand.

AMD is also growing quickly in notebooks, she said. Demand for personal computers hasn’t been hurt by the Covid-19 pandemic as much as the company initially feared, she said on a conference call with analysts.

“We delivered our highest client (PC) processor revenue in more than twelve years,” she said. “We believe our growth was largely driven by our eleventh straight quarter of market share gains.”

Demand for chips for notebooks and servers will increase in the second half, Su said.

Despite the optimism, Su reminded analysts that AMD is “in the early innnings” of its journey to where it expects to be.

Intel’s announcement of further delays in improving its production does not change what AMD has to do, she said.

“The most important thing for us is to execute to our commitments to our customers,” she said. “Basically what we’re asking is for people to trust us with their most important workloads.”

Under Su, AMD has revamped its products and come surging back from what analysts had said was the brink of insolvency. Investors now want the company to justify its soaring valuation by growing to become more than just an afterthought to computer makers. The stock has almost doubled over the past year.

On Tuesday, AMD said it sees 2020 revenue rising about 32%, driven by strength in PC, gaming and data center products. Wall Street expected the company’s sales to climb 25% this year to $8.4 billion. Either way, that is still about half what Intel books in one quarter.

AMD’s achievement of its more than 10% interim server market target still puts it a long way from the more than 20% it achieved about 15 years ago. But it is up from less than 1% before introducing new products in 2017. Server computers are the backbone of corporate networks and the data centers that run the internet. Server chips can sell for thousands of dollars each.

AMD reported second-quarter net income of $157 million, or 13 cents a share, compared with $35 million, or 3 cents, in the same period a year earlier. Revenue rose 26% to $1.93 billion. Profit, excluding certain items, was 18 cents. Analysts estimated profit of 16 cents on sales of $1.86 billion.

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

July 29, 2020 at 08:07AM

https://ift.tt/3jKtjF3

AMD Gains Chip Market Share at Intel’s Expense; Shares Surge - Yahoo Finance

https://ift.tt/2YXg8Ic

Intel

No comments:

Post a Comment