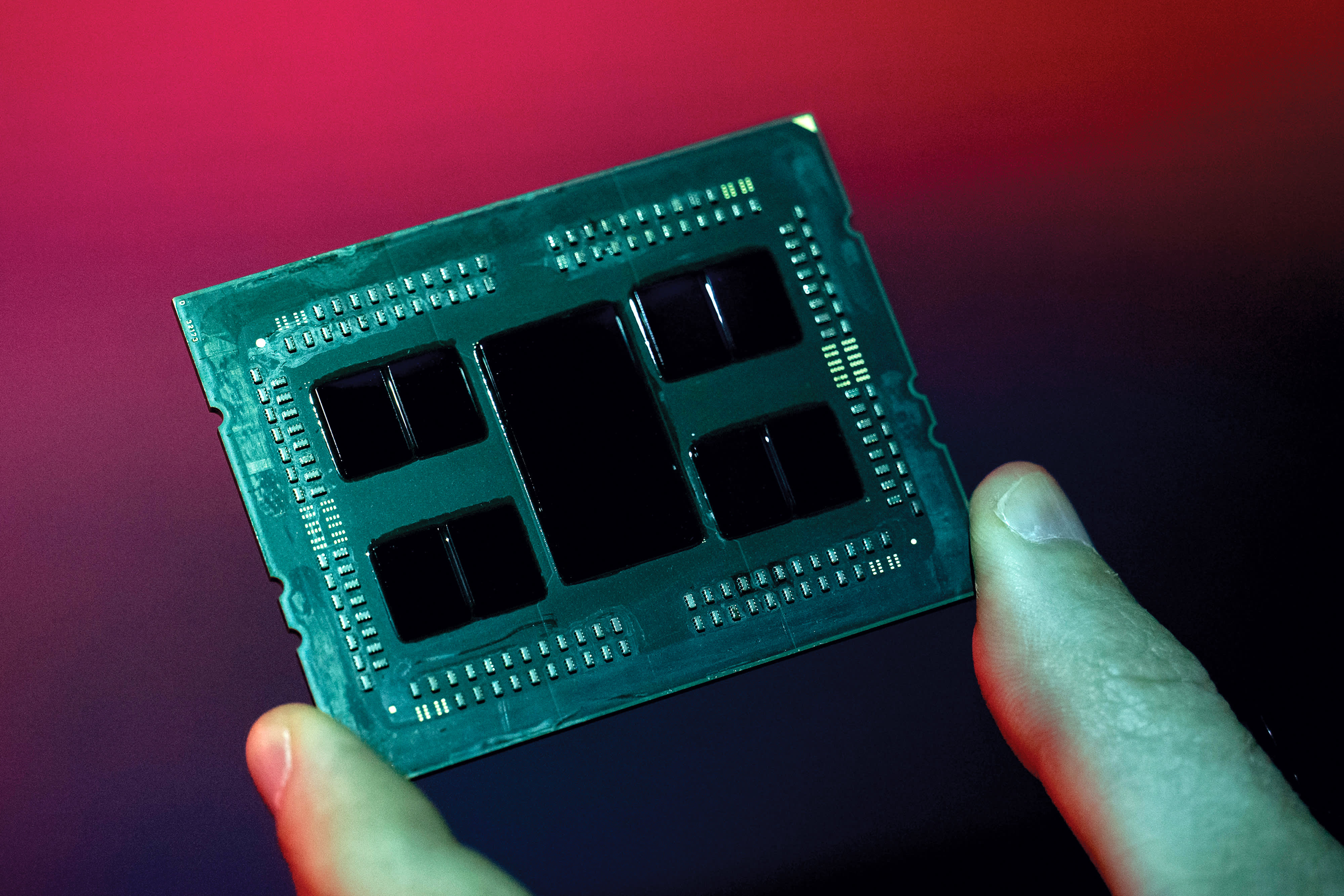

AMD shares hit another record high earlier Monday, continuing to best Intel, its rival chipmaker.

Intel stock plummeted to end last week after pushing back the launch of its 7-nanometer chip by six months.

The two stocks tell a very different story on the chips space. As AMD has rallied 49% this year, Intel has fallen 16%.

Nancy Tengler, chief investment officer at Laffer Tengler Investments, said it could be time to give Intel a chance.

"Given where these stocks are trading on a relative price-to-sales ratio basis, you want to take a fresh look at Intel. You're getting paid a 2.6% yield, it's growing about 7% per year, the earnings were actually good. The report was good, it's just the delay in the 7-nanometer," Tengler told CNBC's "Trading Nation" on Friday.

Intel trades at 2.65 times forward sales, compared with AMD's nearly nine times multiple.

Intel "might be just ready for a turn in growth in relative price-to-sales ratio. And I think that's why we're picking away at it," said Tengler.

Craig Johnson, chief market technician at Piper Sandler, is on team AMD.

"Everybody likes a winner so we'd be buying AMD," Johnson said during the same segment. "It's clearly a tale of two different tapes at this point in time."

Johnson notes the majority of AMD revenue is generated from Sony and Microsoft, "clearly on the graphic and processor side," while Intel derives its revenue from Lenovo and Dell.

"To me moving to a smaller chip size isn't as material as the end-markets being stronger for AMD," he said.

Johnson said the charts suggest AMD could have another 16% upside, drawing a measured objective to $80. The stock traded at $68.61 on Monday.

"I'm a buyer of AMD and avoiding Intel at this point in time," he said.

Disclosure: Laffer Tengler Investments holds Intel.

July 27, 2020 at 11:08PM

https://ift.tt/30SeNCf

AMD vs. Intel shares: Traders debate which is the best bet - CNBC

https://ift.tt/2YXg8Ic

Intel

No comments:

Post a Comment