Intel (INTC) - Get Report shares are getting hurt on Friday, while Advanced Micro Devices (AMD) - Get Report is surging. Interestingly enough, both are moving for the same reason.

Intel stock is down 15% despite beating on earnings and revenue expectations. The company reported profit of $1.23 a share, 12 cents ahead of estimates, while revenue of $19.7 billion jumped 19% year-over-year and beat estimates by almost $1.2 billion.

It was a solid quarter, but its 7nm process will be delayed, with the chips likely not coming until at least 2022. That’s one reason the shares are under so much pressure and it's also why AMD stock is up 15% to highs.

With Advanced Micro Devices already touting momentum in its business, this influx of demand should continue to fuel revenue higher. Investors are hoping it continues to juice the stock price higher, too.

Keep in mind: AMD will report earnings on July 28 after the close.

Nvidia (NVDA) - Get Report also is cashing in on the day, up over 2% while the Nasdaq is lower.

Coming into July, I mapped the potential breakout in AMD and mentioned a potential upside target of $67.87, which is the 138.2% extension.

Above that mark now, let’s see if AMD can climb to $73.19, the 161.8% extension. Earnings will likely play a big role in whether that's accomplished in the near term.

Nvidia is a holding in Jim Cramer's Action Alerts PLUS member club. Want to be alerted before Jim Cramer buys or sells NVDA? Learn more now.

Trading Intel Stock

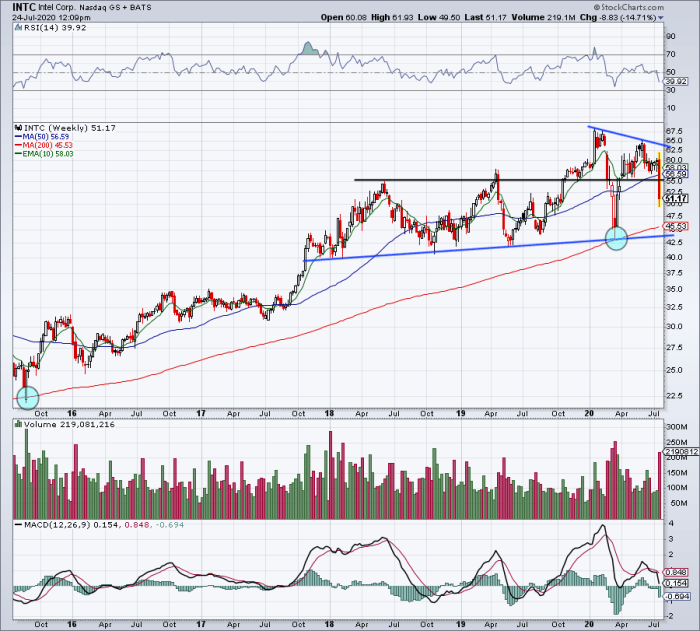

As for Intel, the stock finds itself in sort of a no man’s land here. It’s below all the notable daily moving averages, but some of the more significant weekly and monthly moving averages are still notably lower.

The bulls would have liked to see the 20-week and 50-week moving averages hold as support, along with $55. However, the selling pressure was simply too much, and the shares at this writing are below $51.

On the upside, let’s see if Intel can recapture the 20-month moving average up near $53. Above that gives the stock some momentum and puts that previously mentioned key area in play between $55 and $56.50.

However, a further decline may actually make Intel more attractive. Below $50 puts more downside and a massive level of potential support in play.

The 200-week moving average (currently $45.53) has not often been tested, just twice over the past five years. Each time, though, it led to a robust bounce.

Further, the 50-month moving average comes into play at $44.65, while the mid-$40s were solid support in 2018 and 2019.

I would love a chance to buy the dip into this area, although a close below the March low at $43.38 would be concerning.

July 24, 2020 at 11:49PM

https://ift.tt/2CZyT5n

Intel Stock Chipped on Report - Here's When to Buy the Dip - TheStreet

https://ift.tt/2YXg8Ic

Intel

No comments:

Post a Comment