Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in MediaTek (TPE:2454). Now, I’m not saying that the stock is necessarily undervalued today; but I can’t shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for MediaTek

MediaTek’s Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you’d expect a company’s share price to follow its earnings per share (EPS). It’s no surprise, then, that I like to invest in companies with EPS growth. We can see that in the last three years MediaTek grew its EPS by 5.9% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

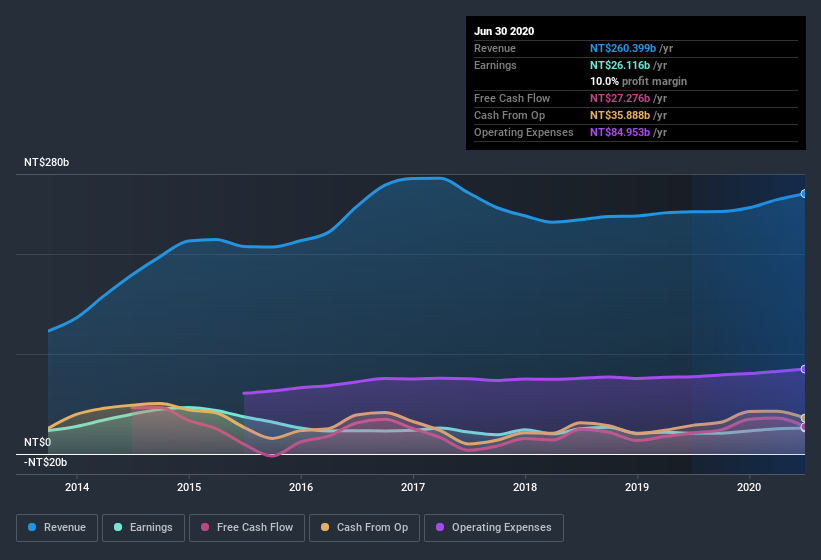

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company’s growth. MediaTek shareholders can take confidence from the fact that EBIT margins are up from 8.0% to 10%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company’s revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don’t drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for MediaTek’s future profits.

Are MediaTek Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a NT$1.1t company like MediaTek. But we do take comfort from the fact that they are investors in the company. Notably, they have an enormous stake in the company, worth NT$127b. This suggests to me that leadership will be very mindful of shareholders’ interests when making decisions!

It’s good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalizations over NT$235b, like MediaTek, the median CEO pay is around NT$38m.

The MediaTek CEO received total compensation of just NT$3.6m in the year to . That’s clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add MediaTek To Your Watchlist?

One important encouraging feature of MediaTek is that it is growing profits. Earnings growth might be the main game for MediaTek, but the fun does not stop there. Boasting both modest CEO pay and considerable insider ownership, I’d argue this one is worthy of the watchlist, at least. We should say that we’ve discovered 1 warning sign for MediaTek that you should be aware of before investing here.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Promoted

If you decide to trade MediaTek, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

These great dividend stocks are beating your savings account

Not only have these stocks been reliable dividend payers for the last 10 years but with the yield over 3% they are also easily beating your savings account (let alone the possible capital gains). Click here to see them for FREE on Simply Wall St.August 13, 2020 at 06:56AM

https://ift.tt/3itvVpg

Here’s Why I Think MediaTek (TPE:2454) Is An Interesting Stock - Simply Wall St

https://ift.tt/3e1uOdC

Mediatek

No comments:

Post a Comment