Ever since Intel (INTC) reported the June 2020 quarter, guided lower thanks to the delay in 7 nm, and floated the prospect of a "fabless Intel" down the road, revisiting past articles on Intel is a good feeling since they reflect the proper analysis.

Here is the most recent article written on Intel from 2019, and then again in August 2015 here, which highlights that, purely and simply, Intel's capex requirement every year is like running a marathon with a piano on your back.

Now that Intel CEO Bob Swan has floated the idea of a "fabless Intel", the stock is sitting in the high $40s waiting to see if this becomes a reality.

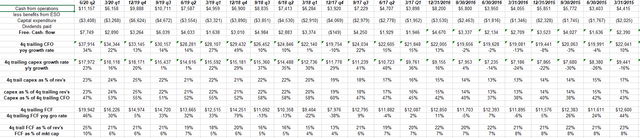

Intel's cash flow and capex:

Source: internal valuation spreadsheet

While these spreadsheets are likely perceived as the height of geekdom for Seeking Alpha readers, they contain important information for investors.

Two lines are important to note for readers: 1.) capex as a percentage of revenue (roughly 9 lines down the s/sheet), and more importantly, capex as a percentage of cash flow (CFO), around line 11.

Intel's capex as a percentage of cash flow as of June 30 was 47%, which can be compared to Apple's (NASDAQ:AAPL) 16%, Texas Instruments (NASDAQ:TXN) 12%, and Amazon's (NASDAQ:AMZN) 45%.

The difference between Intel and Amazon is that Amazon is growing revenue +20% per year, while Intel's revenue growth is closer to a 2% per year average expected over the next 3 years.

Intel traded like a software stock in the 1990s since - even with this capex constraint and the need to build $10-$15 billion in new chip manufacturing fabs every year - Intel averaged 25% revenue growth from 1992 to 2000.

In other words, companies that can generate double-digit revenue growth can leverage their manufacturing base and produce outsized returns on capital (like Amazon does), but Intel's revenue growth days are long gone.

Since the year 2000, when that string of 25% revenue growth ended, Intel has averaged 4% revenue growth over the last 19 years (and the spreadsheet holds the numbers to prove the math.)

Texas Instruments Did What Bob Swan Is Considering, With Great Success

If readers are wondering what the precedent for this is, look no further than Texas Instruments. The company is an analog player, and they went "fabless" in the mid-2000s after the tech-bubble crash, and it paid off handsomely for shareholders.

Today, and for the last 5-8 years, Texas Instruments' "capex as a percentage of cash flow" has averaged in the mid-teens. We/I modeled the company in the late 1990s and all through the 2000s and in the late 1990s to keep up with the tech boom, TXN's capex was actually greater than their operating cash flow, which they funded with debt.

The company got religion in the last 10-15 years and used that excess capital to increase the dividend and repurchase stock.

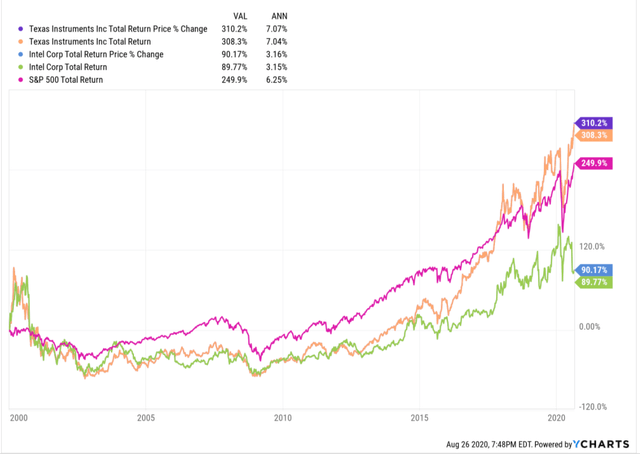

Source: YCharts

The above chart shows that Texas Instruments has beaten not only Intel but also the S&P 500 over the last 20 years, and a big part of that is capital return but also good growth.

Texas Instruments has beaten Intel's "average annual return" for 250-300 bps annually for 20 years.

Summary/conclusion

The potential savings from fabless capex and the annual savings of - well - quite a bit of cash flow could be a substantial catalyst for Intel's share price.

Since 2000, Intel has been stymied or handcuffed by the capex, often having to forego dividend increases such as in the mid-to-late 2000s and then 2012-2014 where the dividend was just maintained for 8-12 quarters, because of the dearth of free cash flow.

The way the stock is trading currently though, it tells me there is some doubt as to whether Intel will go down this road.

You have to wonder to what degree Intel will or can subcontract their manufacturing and what it means for their business 10-20 years from now.

It's certainly worked well for Texas Instruments, but perhaps, analog is easier to subcontract than Intel's chipset business.

Although the PC business has gotten a boost from WFH (work from home), the secular growth of the PC business has been low single digits for years, and thus, I wondered why Intel didn't consider something like this sooner.

Today, Intel fits into the "value tech" category. Another 1990s tech giant that has had trouble adapting to the post-2000 technology world. Intel, Microsoft (NASDAQ:MSFT), Oracle (NYSE:ORCL), and so many others benefited greatly from the secular build-out of corporate technology, but since the 2000s and the iPhone, it's been a consumer device world, with mobile, social, and the rest.

If the Intel Board and Bob Swan are serious about this initiative, I think the stock is undervalued and not by a little bit, but it depends on the degree that capex can be reduced and if the Board will return that capital to shareholders.

Watch the capex number in coming quarters and, in particular, the 2021 capex "guide" to see if Intel is just blowing smoke or if this is for real.

For clients, the stock will be accumulated down to $40 on any market pullback, and $39 would be a stop-loss level, and that's where I would think that I could be wrong on the premise of the buyback.

Disclosure: I am/we are long INTC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The Link LonkAugust 27, 2020 at 09:29PM

https://ift.tt/3b2dh5i

Intel's CEO Bob Swan Is Right: A Fabless Intel Is Fabulous For Shareholders. Here's Why - Seeking Alpha

https://ift.tt/2YXg8Ic

Intel

No comments:

Post a Comment