Source: zdnet.com

Introduction

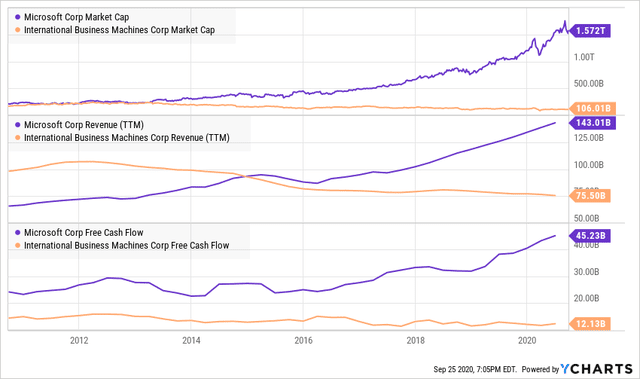

Intel (INTC) finds itself in a situation very similar to what Microsoft (MSFT) and IBM (IBM) were ten years ago. For many years, Intel has dominated the CPU markets, and its PC-centric business became a cash cow (low to no-growth expected going forward). However, with its dominance in PC markets under severe threat from AMD (AMD) (and now Nvidia+Arm (NVDA)), the semiconductor giant needs to rapidly evolve if it wants to deliver robust shareholder returns over the upcoming decade.

In my opinion, Intel's strategic transformation to a data-centric company has the potential to generate steady revenue growth over the next ten years, similar to what Microsoft achieved in the 2010s and what IBM has heretofore failed to do. With continued revenue growth, I expect Intel's free cash flow to trend higher, which will correspondingly drive its share price higher.

In the image that follows, I juxtapose IBM's performance with Microsoft's over the last ten years.

Source: YCharts

Source: YCharts

Companies that fail to perpetually reinvent themselves stagnate, and as a result, their shareholders suffer. A look at the chart above exemplifies this idea. In the last ten years, Microsoft saw a resurgence, while IBM went through a slow decline. Now, both of these tech giants continued to make a lot of money, but Microsoft's stock became a 15X bagger while IBM's share price declined 20%. So, what does the future hold for Intel? Will it be the next IBM or Microsoft? Here's are my thoughts:

- Intel's data-centric business now contributes more than 50% of total revenues and grew from $7.59 billion to $10.24 billion (up 35% y/y) last quarter.

- The demand for Intel's data-centric products should remain elevated for the foreseeable future as numerous secular growth trends viz. hyperscale cloud, enterprise digital transformation, 5G, IoT, AI, and autonomous vehicles continue to accelerate around us.

- Intel will continue to deliver single-digit revenue growth over the next decade on the back of the strength in its data-centric businesses. This revenue growth will drive free cash flow and, correspondingly, its share price higher.

- Critics and skeptics of Intel continue to point to its loss of market share in the PC segment as evidence of its decline, but I believe that Intel's ceding of market share in that market is strategic and by design.

- Hence, I believe Intel's trajectory will more resemble Microsoft's than IBM's, but perhaps only because it is so centrally at the heart of so many secular growth trends that it will struggle to perform poorly. Intel's management and ability to execute have both been abhorrent as of late.

According to my estimates, and granted Intel does not continue to execute abhorrently time and time again, Intel's data-centric business alone is worth $355 billion (or $83 per share). Hence, the stock is significantly undervalued, and as a result, I rate Intel a buy at $50.

Today, we will explore Intel's data-centric business in greater depth, after which we will run it through the L.A. Stevens Valuation Model to ascertain its intrinsic value.

A Look At Intel's Evolution

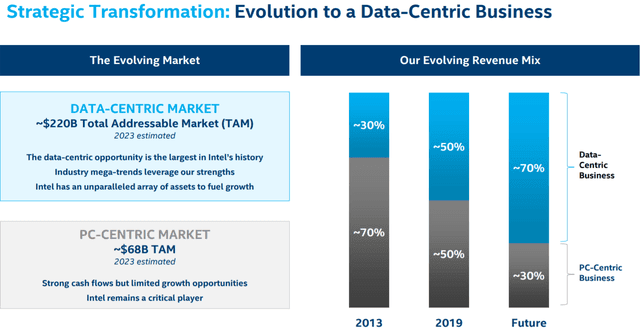

Considering the limited growth opportunity in the PC-centric market, Intel's management proposed a strategic transformation towards a data-centric future in 2017. We know that with the advent of 5G and other emerging trends like cloud computing, IoT, AI, and enterprise digital transformation, the data-centric market will grow in size over the next few years.

Source: Intel 2020 Spring Stockholder Outreach Presentation

According to Intel, the data-centric market could have a TAM of $220 billion by 2023, while the PC-centric market TAM will be $68 billion. Assuming Intel manages to hold onto the majority of the market share in PCs, the change in revenue mix shown in the graph above should result in robust revenue growth in Intel's data-centric business. And the latest quarterly numbers serve as evidence.

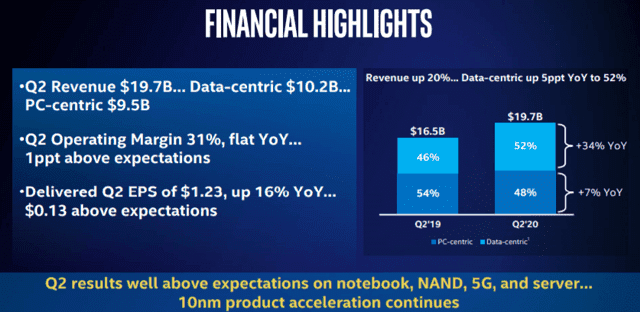

Source: Intel Q2 Earnings Presentation

In Q2 2020, Intel's data-centric business revenues grew from $7.6 billion to $10.2 billion (up ~35% y/y). This strength in the data-centric business powered the total revenues higher by 20% y/y. Moreover, the revenue mix has shifted drastically, and Intel can now be looked at as a data-centric business.

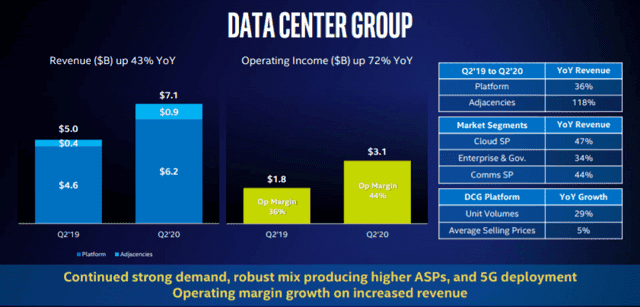

The primary driver of Intel's revenue growth was the data center group [DCG] that witnessed strong demand and higher ASPs. A closer look at DCG shows massive growth across all the market segments (Cloud - 47%, Enterprise & Gov. - 34%, and Comms SP - 44%). Hence, Intel's products remain in high demand in the data center, notwithstanding the relentless chorus of bearish theses at present.

Source: Intel Q2 Earnings Presentation

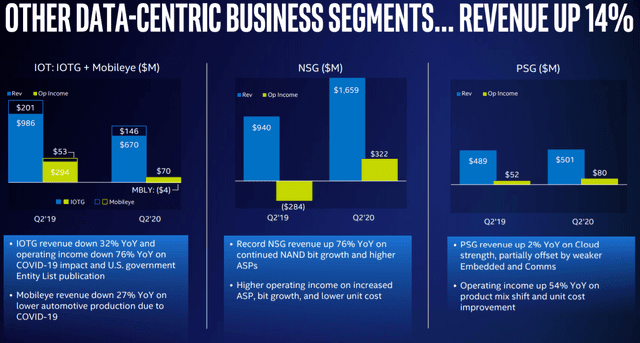

Now, Intel's data-centric business involves a few other assets/groups, namely IoT, NSG, and PSG. The IoT group consists of futuristic assets like Mobileye (autonomous vehicles). For now, the revenues from IoT remain negligible, but investors should keep an eye on the progress of this group to monitor Intel's success in the autonomous vehicle market.

Source: Intel Q2 Earnings Presentation

The NSG group consists of Intel's memory products, and the explosive growth in data should continue to drive the demand for these products higher. Last quarter, NSG revenue grew by 76% y/y to a record figure of $1.66 billion.

Over the next few years, I expect to see the growth in Intel's data-centric business to remain healthy. However, in the face of rising competition from traditional rivals - Nvidia and AMD and new entrants (cloud companies) like Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Google (NASDAQ:GOOG) (NASDAQ:GOOGL), and Facebook (NASDAQ:FB), I will be using a conservative growth rate of 10% for valuation purposes.

Valuing Intel's Data-Centric Business

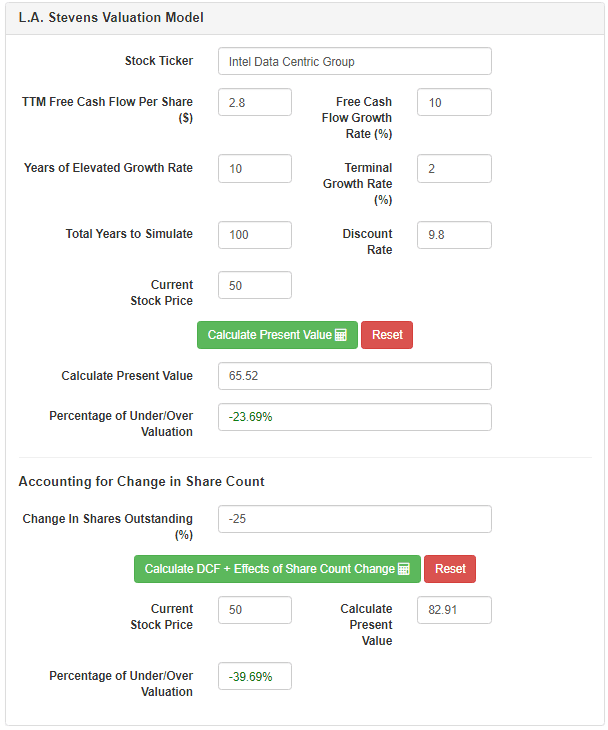

In this section, I will be valuing Intel's data-centric business on a standalone basis. To do so, I will be utilizing the L.A. Stevens Valuation Model. Here's what it entails:

- Traditional discounted cash flow Model using free cash flow to equity discounted by our (as shareholders) cost of capital.

- Discounted cash flow model including the effects of buybacks.

- Normalizing valuation for future growth prospects at the end of 10 years. (3a.) Then, using today's share price and the projected share price at the end of 10 years, we arrive at a CAGR. If this beats the market by enough of a margin, we invest. If not, we wait for a better entry point.

- Assessing the impacts of dividends and the growth thereof on total expected return.

Here are the results:

| Assumptions | Value |

| Data-centric revenue | $40B |

| FCF Margin (Long Term) | 30% |

| Shares outstanding | 4.284B |

Source: L.A. Stevens Valuation Model

As you can see above, Intel's data-centric business is worth $82.91. Hence, the market is grossly mispricing the semiconductor giant. For the purpose of experimentation, let's assume Intel's PC centric business does not exist. Let's project the expected returns for Intel (data-centric business only).

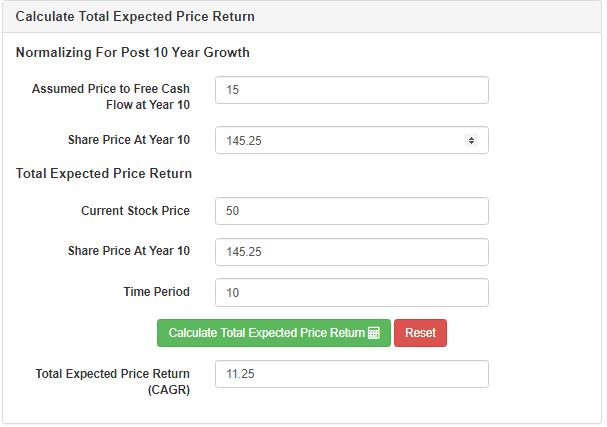

To determine the total expected returns (of the data-centric business only), we must project the growth of free cash flow per share for the next ten years. To do so, I grew the aforementioned free cash flow per share and multiplied it by a conservative price to FCF ratio of 15x. Intel trades at a Price to FCF multiple of ~10x right now, but such a discount may not last very long.

Source: L.A. Stevens Valuation Model

Source: L.A. Stevens Valuation Model

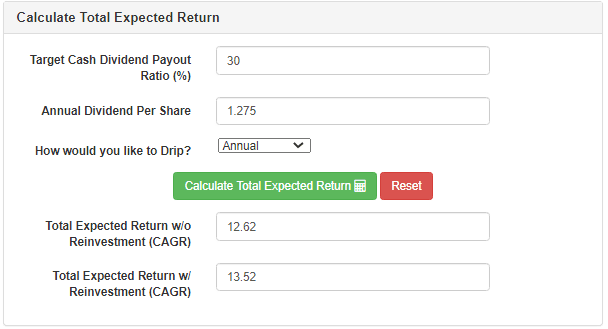

So, if one were to buy Intel at $50 and hold for ten years, he/she could expect share price appreciation at 11.25% CAGR. Considering Intel's sizable dividend, the total expected return without dividend reinvestment is 12.62% CAGR, and the total expected return with dividend reinvestment is 13.52% CAGR.

These returns are considerably higher than the 90-year annualized S&P 500 return rate, and they do not even account for Intel's PC-centric business. Hence, I expect Intel to outperform the S&P 500 over the next decade. Thus, I recommend dividend growth investors to make most of this opportunity by adding Intel to their portfolios.

Concluding Remarks

The threat of ARM-based chips looms large over Intel's data center aspirations; however, for now, Intel continues to dominate the market. Furthermore, the demand for 5G, IoT, and AI products is likely to grow over the next decade or so, and Intel will benefit from these secular trends.

Over the next few years, Intel could very well cede market share to rivals like AMD and Nvidia; however, the massive growth of the data-centric market ($220 billion TAM) could lead to increased revenue and free cash flow. According to my estimates, Intel's data-centric business is worth $83 per share on a standalone basis. Hence, an investor buying Intel today is purchasing the data-centric business at a deep discount and getting the cash cow (PC-centric business) for free.

With modest revenue growth and aggressive capital return programs, Intel could quite comfortably deliver double-digit returns over the next decade. Thus, I believe Intel is more likely to be closer to Microsoft than to the IBM of the 2020s; however, management remains a strong concern of mine, and I will be monitoring the developments in that realm over the coming years.

Key Takeaway: I rate Intel a buy at $50.

Let me know what you think in the comments below!

Thanks for reading; remember to follow to get more stock ideas; and happy investing!

Beating the Market: The Time Is Now

There has never been a more important time in stock market history to buy individual stocks at the heart of secular growth trends. Mature market performers/underperformers and index funds simply will not cut it, as we face a decade during which there is absolutely no guarantee the overall markets will rise.

This is why the time is now to discover high-quality businesses with aggressive, visionary management, operating at the heart of secular growth trends.

And these are the stocks that my team and I hunt, discuss, and share with our subscribers!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The Link LonkSeptember 29, 2020 at 09:40PM

https://ift.tt/3cJz7LN

Intel: The Market Is Missing The Point - Seeking Alpha

https://ift.tt/2YXg8Ic

Intel

No comments:

Post a Comment