Introduction

Intel (INTC) stock dropped hard after reporting a delay in the release of their 7nm chipsets despite reporting strong Q2 performance. This delay means the new chips, which were scheduled to be released by end of 2021, won't arrive until late 2022, or early 2023.

Source: Bing

Mr. Market is concerned about Intel sliding into irrelevance. The analyst downgrades are primarily due to the fact that Advanced Micro Devices (AMD) already has its 7nm chips in the market and will slowly steal Intel's market leadership. I do not believe that Intel is a dinosaur and wanted to share my view on the company through this article.

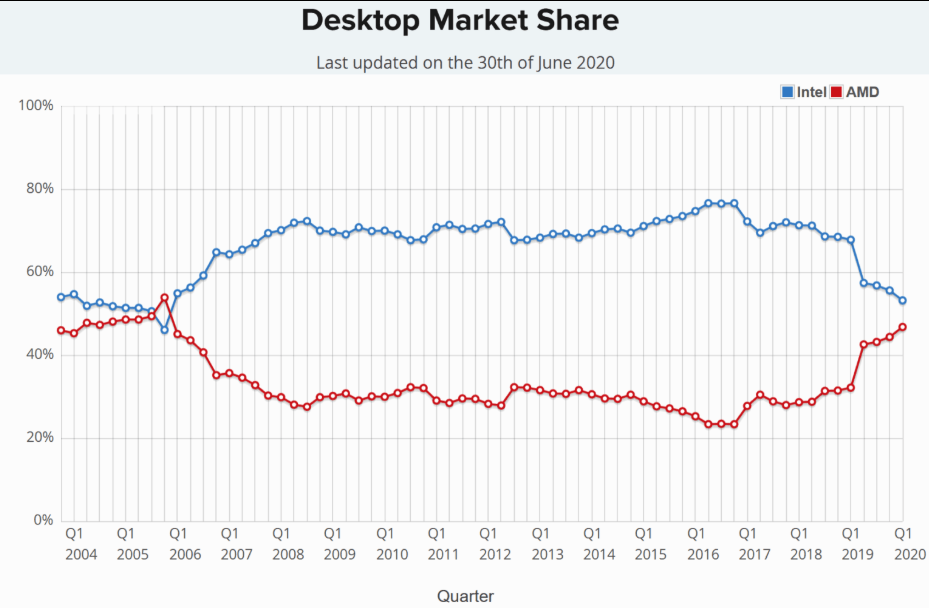

Desktops & Laptops

Image Source: hardwaretimes.com

Worldwide sales of laptops have eclipsed desktops for more than a decade. In 2019, desktop sales totaled 88.4 million units compared to 166 million laptops. That gap is expected to grow to 79 million versus 171 million by 2023 (source). I am not worried that AMD is starting to acquire significant market share in a declining market.

Image Source: weforum.org

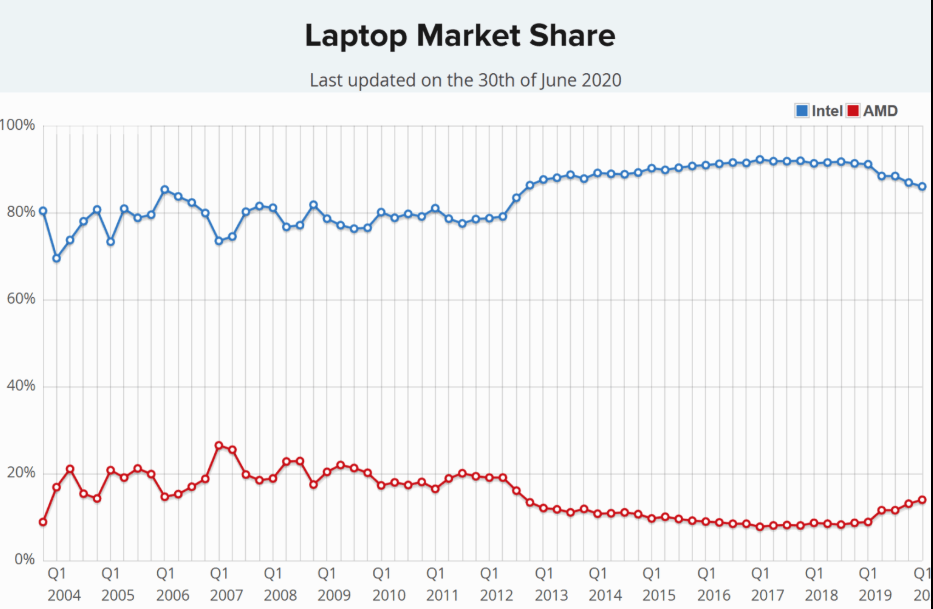

It is important to keep in mind that benchmarks primarily include above-average users including enthusiasts, reviewers and other testers whose usage may not represent average users. Very few mainstream PC users make use of services such as PassMark, limiting the website's database to a niche audience.

Nevertheless, with the data from PassMark, we can see that Intel still maintains a significant lead in market share in the laptop segment. Will the 7nm delay affect this? It might, but is that a problem? In my opinion, the new processors announced by Intel will enable the company to continue to maintain a good lead in the laptop market share (more about the new release will be discussed later in the article).

Image Source: hardwaretimes.com

Image Source: pcmag.com

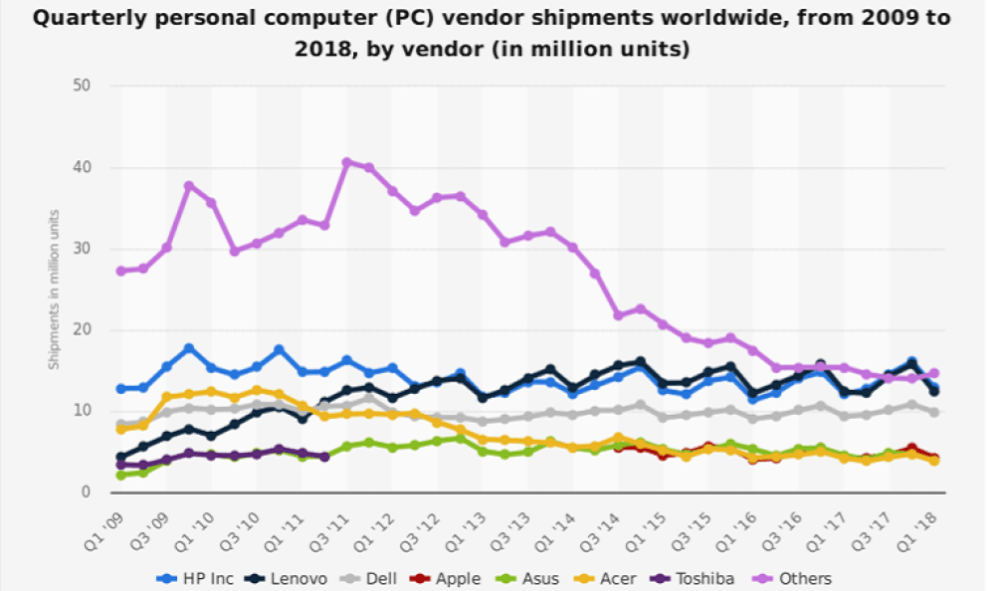

The computing device market is expected to shrink to 372.6 million shipments in 2023, according to IDC's release. Despite sudden surge in PC demand due to the pandemic and the need to work-from-home, in my opinion, in the long term, mobile workstations, tablets and light computing devices will grow in market share.

Apple Macbooks and iMacs

Apple (AAPL) recently announced the transition to the Arm Ltd.-based PC for the macOS at its online Worldwide Developers Conference and said it would complete the process by 2021. Mr. Market is seeing this as bad news for Intel, but in my opinion, Intel's chip business with Apple accounts for approximately 2% to 4% of Intel's sales. Looking at Intel's trailing 12-month revenue of more than $75 billion, Apple relationship represents between around $1.5 - $3.0 billion in annual sales for the chip maker. I don't think it hits Intel at all. Moreover, Apple is switching to its own processors, and not going to AMD.

Chromebooks and Mobile Computing Devices

The NPD Group reports that four Chromebooks have been sold for every non-Chrome notebook that's been sold. That translated to 109% growth for Chrome OS devices overall YoY during the first quarter. The report also mentions that the growth was even stronger in education and enterprise, where Chromebooks grew 155 percent during Q1. In my opinion, as the ability to work / study remotely expands, the adoption of tablets and light computing devices such as Chromebook will grow.

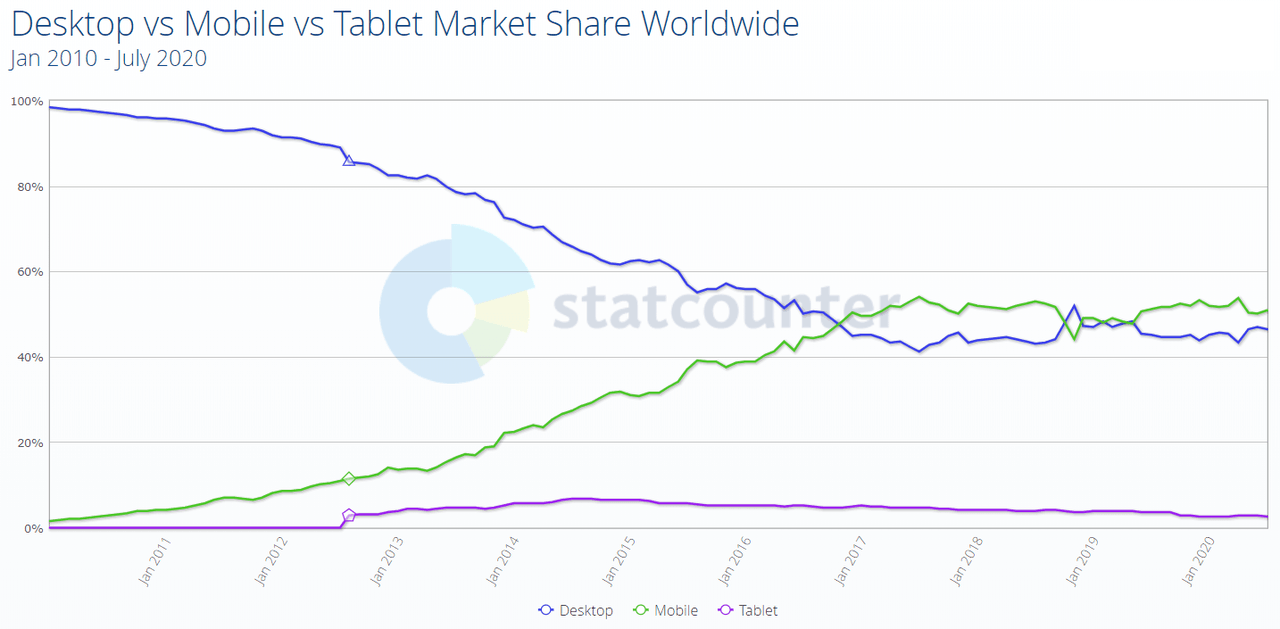

The desktop and laptop markets have seen a slow and steady decline since the mobile device boom.

Image Source: GlobalStats

Neither Intel, nor AMD is a major player in the mobile CPU space, so I will not discuss that further. But the fact remains that conventional PC (laptop or desktop) is on the decline, unless it is for specific purposes such as gaming, development, graphic design, etc., which I would group under a niche market.

As-A-Service

It sounds cool and catchy whenever there is something-as-a-service. The popular subscription services are "Infrastructure-as-a-service", "Software-as-a-Service, "Streaming-as-a-service". There are many more where they came from and the exhaustive list is better provided here.

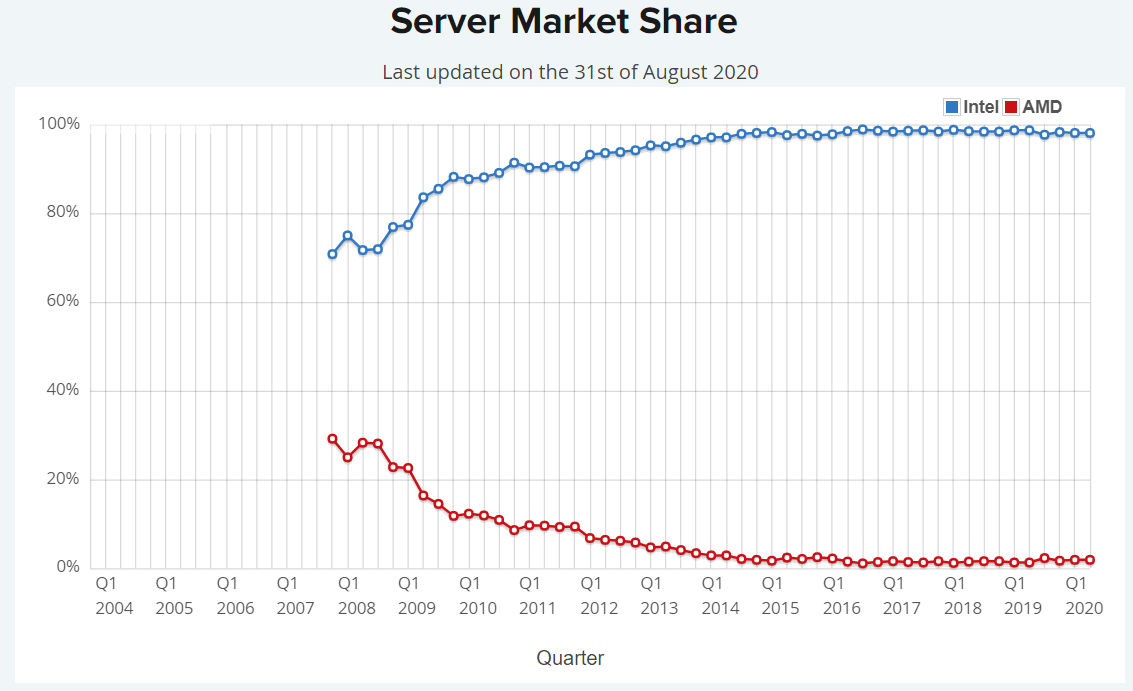

Intel dominates the server and data center market share and continues to invest heavily in strengthening its role in this space. CPU demand for servers and data centers are rapidly growing due to the increased cloud adoption. With Google (GOOG) GCP, Amazon (AMZN) AWS and Microsoft (MSFT) Azure investing aggressively in cloud, it is fair to say the server and data center market is at its early stages of growth. As the cloud space gets more competitive, Intel is growing as well.

Leading cloud service providers, including Alibaba, Baidu, Facebook and Tencent, announced they are adopting our third-gen Intel Xeon Scalable processors into their infrastructure and services Bob Swan, CEO

Image Source: cpubenchmarks.net

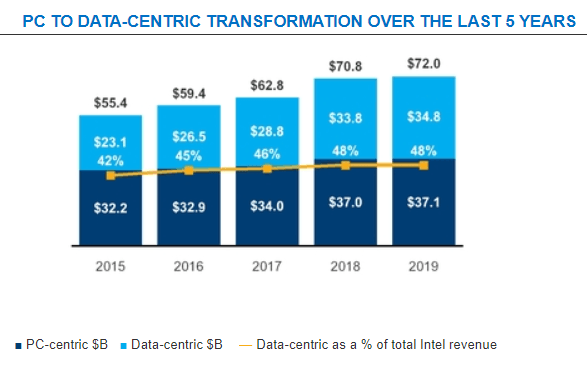

Intel has been transforming itself from a PC business to a data-centric business in the past 5 years. Intel obviously has the first mover advantage in the space and has more than 90% of the market to itself. But there is plenty of growth in this market and a little bit of competition is healthy to have. I am not worried about AMD growing in this space, mainly because Intel has better margins and that is the healthy aspect I would like to see as an investor. I'll discuss more about margins and valuation later in the article.

Image Source - Intel form 10K

Tiger Lake Architecture

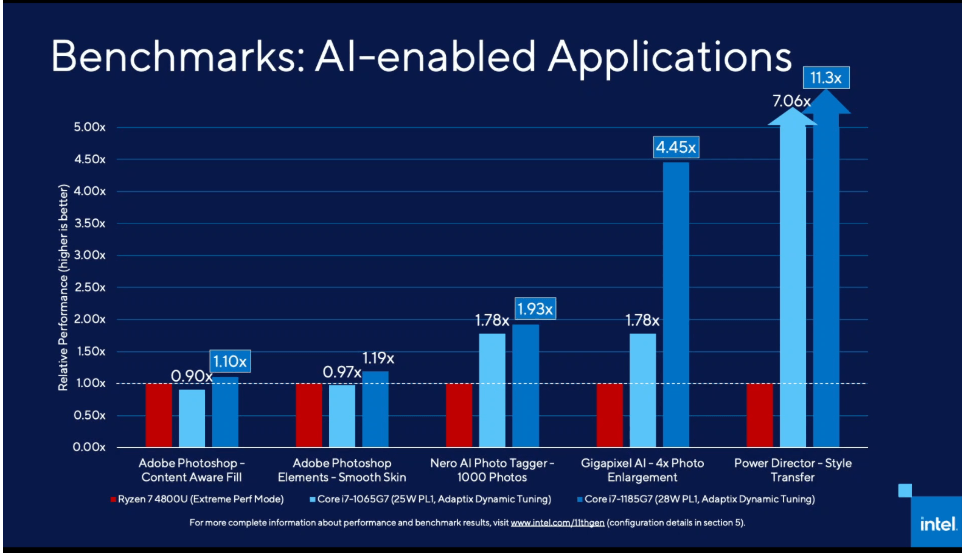

Intel's 11th generation chipsets featuring the company's Tiger Lake architecture was launched yesterday and the company is directly competing with AMD's Ryzen series. Early benchmarks conducted by Intel show the new processor outperforms the Ryzen 7 4800U in every heavy duty application they tested for. Early benchmarks already put Intel's 10nm processors ahead of AMD's 7nm processors in performance. It is still early in the launch and real world performance is yet to be tested. I look forward to seeing benchmarks conducted by independent analysts.

Image Source: pcworld.com

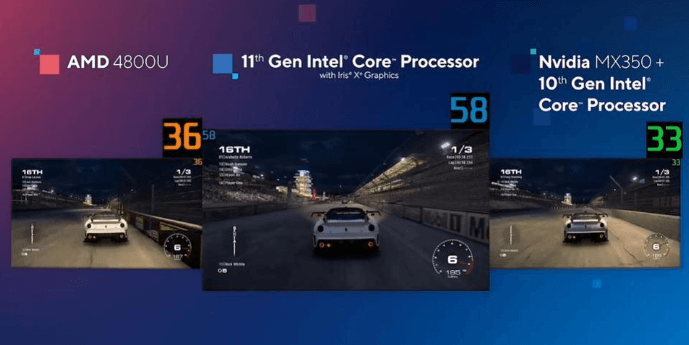

The new processors come with new Iris X Graphics which puts Intel as a strong contender in the gaming industry. Previously, Intel processors used to come with UHD graphics which the industry would often call a "potato". Gamers would often look elsewhere for their GPU needs. I am happy to see the 11th generation processors with significantly improved graphics capabilities.

Image Source: Forbes

Image Source: Forbes

Returns to Shareholders

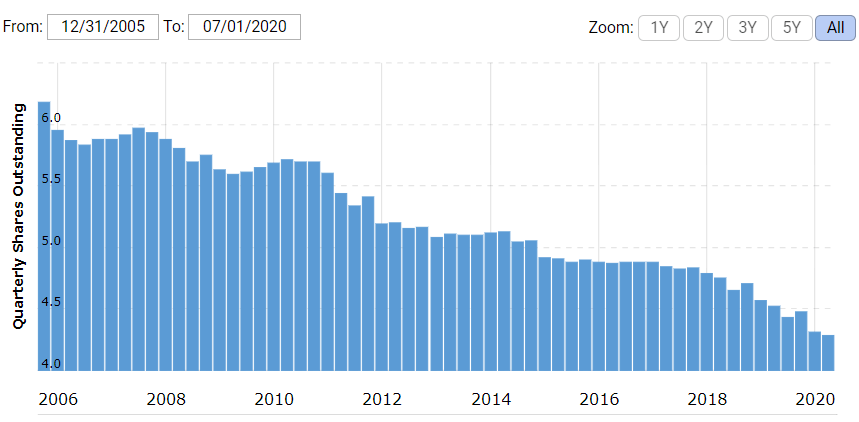

Intel has a strong history of rewarding shareholders through common stock buybacks and dividends.

Intel announced a $10 Billion share buyback program, which was suspended in March due to the uncertainties created by the pandemic. Since 2015, the company has reduced its outstanding shares by 13%.

Image Source: macrotrends.net

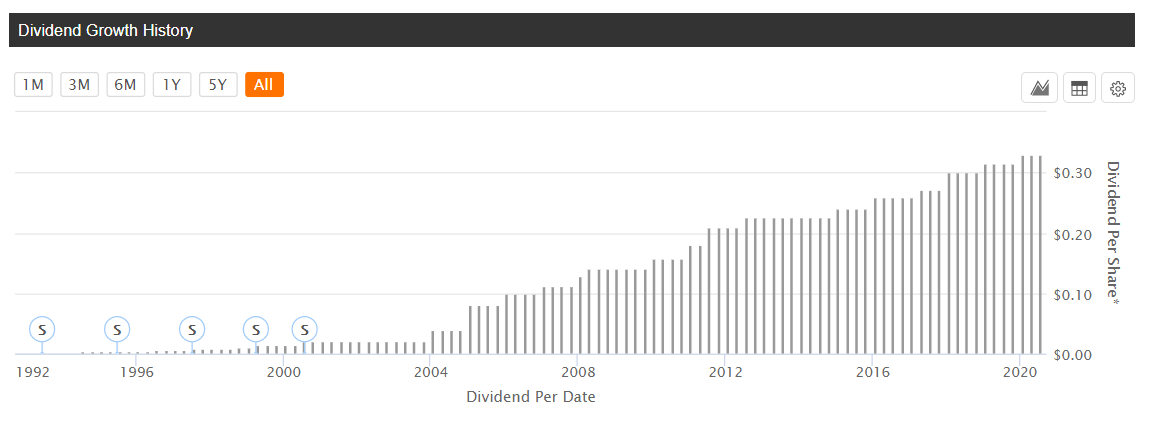

Intel's current annual dividend payout of $1.32 (2.53% annually) may appear small, but it is a reliable one with a low payout (24%). Moreover, Intel has a history of raising dividends.

Source: Seeking Alpha

Source: Seeking Alpha

Unfortunately, Mr. Market today finds dividends and buybacks to be very boring activities. Instead, dilution and heavy insider selling are propelling certain stocks to even higher levels. I believe Mr. Market's distaste for investor friendly financial practices is short lived and investors will be rewarded for their patience in the long run.

Intel has spent more in R&D in a single year than AMD and Nvidia's combined spend in the past 3 years. This provides Intel plenty of resources to pull up its socks in the event of a threat to its market share dominance.

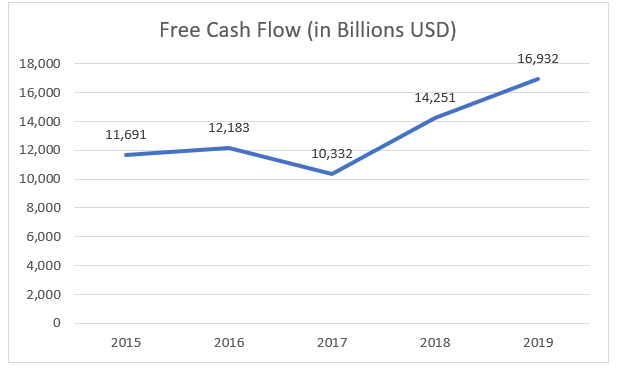

Data Source: Forbes

Dominance in the personal computer, server and data center chipset space is Intel's strong moat, which is well protected by its unparalleled R&D spend. As a result, Intel is a great free cash flow producer, which fuels its shareholder friendly practices.

Data Source: WSJ

Valuation and Margins

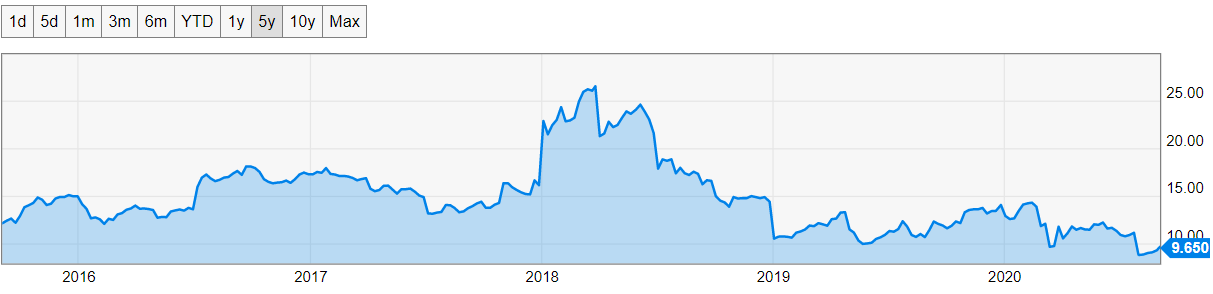

Plenty of articles on Seeking Alpha outline the strength in Intel's current valuation. Intel's PE ratio below 10 is its lowest in the past 5 years, and in my opinion, is unlikely to stay this way for long. The powerful launch of the company's 11th generation processors, with capabilities to provide serious competition to AMD and NVIDIA is a strong catalyst for the stock.

Source: YCharts

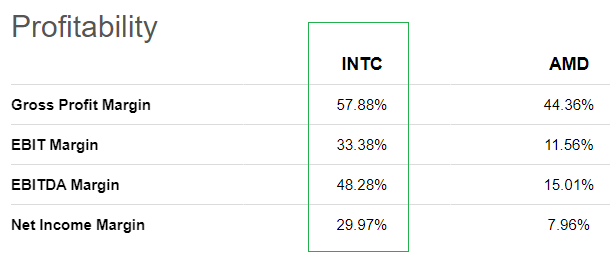

AMD's market share in data centers is slowly growing to offer competition to Intel. Major cloud service providers are offering AMD Epyc along with Intel Xeon processor options for cloud computing needs. Though this remains a point of concern, I am less worried because AMD's lower margins reduce its flexibility with pricing.

Data Source: Seeking Alpha

AMD's 7nm chip manufacturing is done by Taiwan Semiconductor (TSM). AMD also relies on GlobalFoundries, a former subsidiary of the company, to manufacture 12 and 14nm processors. This story is very similar to how Chinese EV manufacturer - Nio (NIO) uses Chinese state owned manufacturing facility - JAC to produce its EVs, while Tesla (TSLA) is building its gigafactories to achieve full control over production. In the long run, Tesla will be able to control and optimize its margins better than Nio. If we fast forward this story by about 20 years, Intel is in that position of better margins and optimization, and this in my opinion, is Intel's moat in the industry.

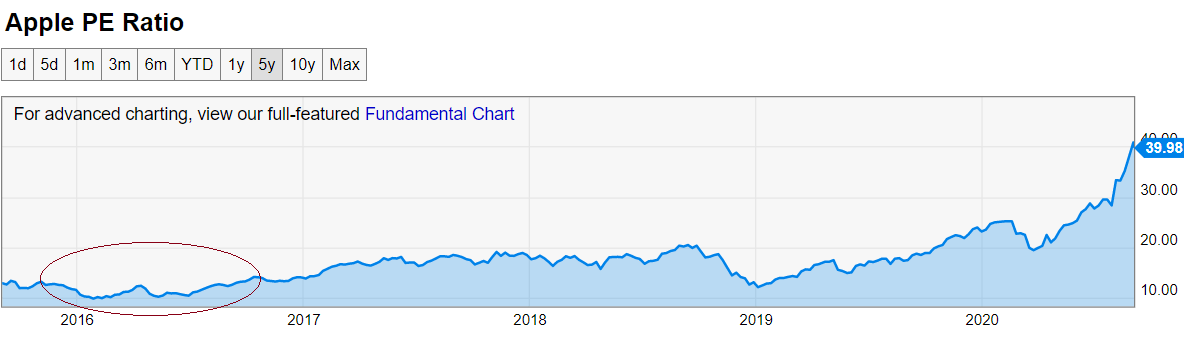

Sven Carlin's article correctly points out the similarities between Apple in 2016 and Intel today. At a point where Apple was a company with very small YoY revenue growth, performing boring activities like common stock buybacks and dividends.

Source: YCharts

These are the activities that solidified its fundamentals and set the company for success in the long term. I believe Intel is taking those correct steps at this time.

Conclusion

Image Source: theverge.com

$10 Billion in share buybacks is a great incentive for value investors. Intel's strong market position in laptops, servers and data centers is likely to continue to be a source of free cash flow for the company. Unparalleled R&D expenses put Intel in a strong position to lead new market segments. Newly launched processors have potential to expand existing markets by challenging unique advantages present in competitor products. Current valuation offers a very attractive entry point for long term investors.

Disclosure: I am/we are long INTC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The Link LonkSeptember 05, 2020 at 12:58AM

https://ift.tt/2QYDl8k

Intel: A Market Leader At A Great Price - Seeking Alpha

https://ift.tt/2YXg8Ic

Intel

No comments:

Post a Comment