In 2017, Intel (INTC) acquired Mobileye for $15.3 billion, moving its automotive unit to Israel. The acquisition represented a massive new market entry for the company. However, 3 years later, as Intel's share price has stagnated at a single digit P/E ratio, and new technology companies are seeing their valuation increase dramatically, it's time for Intel to spin off Mobileye.

Intel - Motley Fool

Mobileye Acquisition Valuation

Intel bought Mobileye in mid-2017 for $15.3 billion. By most estimations, the company paid a fairly expensive price at the time for the company.

Mobileye earned 1Q 2017 revenue of $125 million (before it was acquired) a substantial 66% QoQ increase from the quarter one year earlier. The company earned GAAP net income of $33.5 million and GAAP net cash from operating activities of almost $57 million. That means the company acquired the company for 30x annual revenue and 114x annual GAAP EPS.

That's, by any measure, an expensive valuation.

From there, however, significant growth has continued. The company has increased annual revenue towards $880 million for 2019 and authors, such as those on Seeking Alpha, believe the company could hit $5 billion revenue by 2023. Based on the historic P/S target, as analyzed in that article, it could be valued at $135 billion.

Peer Valuation Change

However, despite the enormous revenue potential for Mobileye, in a market where tech stocks are high flying but Intel is struggling to crack a double-digit P/E ratio, there's significant value in spinning off a business that costs more than half of its enterprise value based on its own historic price and sales.

That doesn't include the significant multiple expansion that self-driving companies have experienced. Let's look at a few, such as Tesla (NASDAQ:TSLA) and Nvidia (NASDAQ:NVDA), two of the best known self-driving companies.

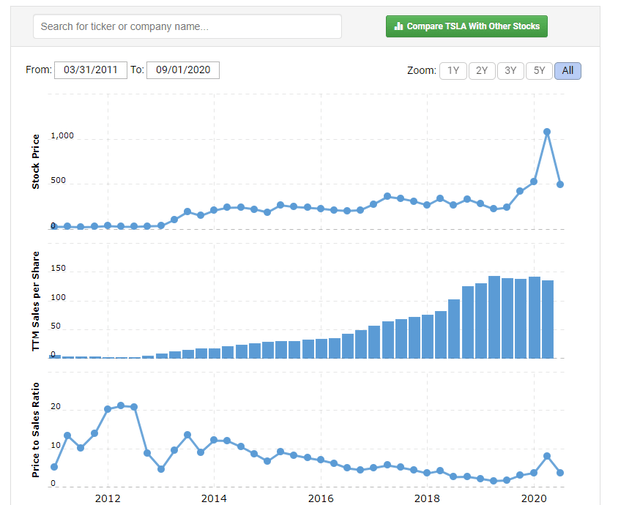

Tesla Price / Sales - MacroTrends

Tesla's price per sales ratio is available above. It's worth noting the recent decline is skewed because of the company's 5 for 1 sales drop. Realistically, the company's P/S ratio at the current time is actually 20 versus 8 at the last time. That puts the company's Price / Sales ratio back to where it was in 2012 before its major product releases.

That would imply that Tesla has actually gone to 2-4x of its long-term Price / Sales multiple. The same amount for Mobileye would push that $135 billion valuation towards $405 billion at the midpoint.

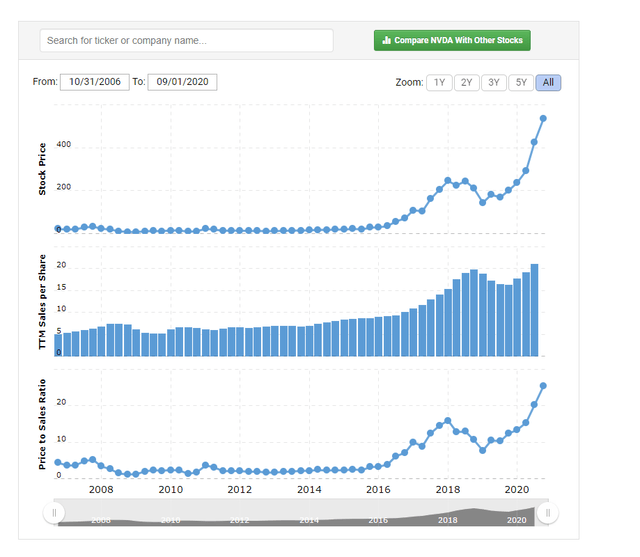

Nvidia Price / Sales - MacroTrends

Simultaneously, Nvidia's share price is up by 70% from its mid-February peak and nearly 150% from its mid-March lows. Even given valuations of Mobileye at roughly $35 billion based solely on where it was 3-4 months ago, the recent run up would still represent a Mobileye valuation of potentially $50+ billion had it gone through the same run up.

However, as Tesla and Nvidia have ignored semblance of financial reason and moved towards a "market opportunity pricing", with subsequent expansion in their price / sales ratios, there's no reason that Mobileye couldn't have done the same moving up towards the hundreds of billions of dollars in potential valuation as a strong independent company.

Mobileye Opportunity

The opportunity in Mobileye comes through the value that's currently locked up through Intel. We believe that Mobileye deserves a much higher valuation in Intel's business but it hasn't received that valuation due to the larger concerns that Intel has faced. Specifically, concerns over a move away from Intel processors to ARM processors and manufacturing issues.

As a result, as highlighted in our recent article on AT&T (NYSE:T) spinning off DirecTV, Intel could generate significant shareholder rewards by spinning off Mobileye and sending that money to shareholders. The company, assuming the same gross margin of 27% at the time of the acquisition, could have profits of >$1.3 billion by 2023 annualized.

In contrast, between a maximum price to sales expansion valuation of $400 billion and a reasonable financial valuation of $50 billion, we'll assume spin-off prices of roughly $135 billion. That's representative of where the company's valuation might be, even before a potential massive inflation in prices.

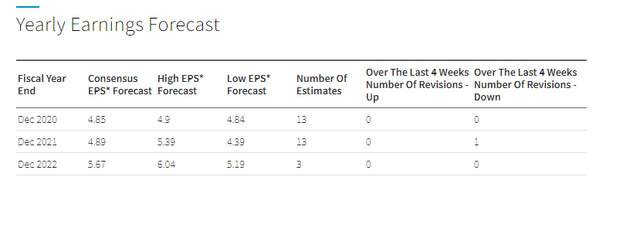

Intel Earnings Forecast - NASDAQ

Intel has 4.3 billion outstanding shares that have declined significantly over the past years, with 2020 EPS forecast from analysts of $21 billion raising to $24 billion by December 2022. The company would have the opportunity to liquidate roughly half of its enterprise value while declining profits by roughly 6%.

That could lead to a significant increase in recent shareholder rewards. The company could pay off its entire debt and have a significant net cash position, it can adopt an aggressive buyback plan, or a number of other measures. All of these things stand to benefit shareholders significantly and are worth paying close attention to.

Our Opinion

Our opinion is that Intel is in a rut struggling to hit a double-digit P/E ratio. However, the incredible high flight of tech stocks over the past months, perceived as entering "new businesses" presents a unique opportunity to drastically increase cash flow. Intel could realistically earn a minimum of 25% of its EV with a 6% drop in 2023 profits.

Alternatively, the valuation the company achieves could actually be much higher, especially if it attempts an IPO with a smaller number of shares (i.e. a 20% IPO at a $100 billion valuation enabling Intel to earn nearly 10% of its EV as cash). This could provide significant short-term shareholder rewards, something we recommend paying close attention to.

Conclusion

Recent tech investments have been flying incredibly high recently and Intel stands to benefit substantially from that. The company's Mobileye division is a leader in self driving technology and the company stands to benefit substantially from that. The company could explore a number of opportunities to provide immediate shareholder rewards.

Intel itself is a quality investment worth paying attention to. The company has more than $20 billion in annual EPS that's currently expanding. Its Mobileye division is expected to only cover 6% of 2023 EPS. That means minimal EPS loss for significant cash flow. On the back of this opportunity alone, investors should invest in Mobileye.

The Energy Forum can help you generate high-yield income from a portfolio of quality energy companies. Worldwide energy demand is growing and you can be a part of this exciting trend.

Also read about our newly launched "Income Portfolio", a non sector specific income portfolio.

The Energy Forum provides:

- Managed model portfolios to generate high-yield returns.

- Deep-dive research reports about quality investment opportunities.

- Macroeconomic market overviews.

Disclosure: I am/we are long INTC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The Link LonkSeptember 01, 2020 at 10:24PM

https://ift.tt/31MkWBE

It's Time For Intel To Spin Off Mobileye - Seeking Alpha

https://ift.tt/2YXg8Ic

Intel

No comments:

Post a Comment