Source: 123rf

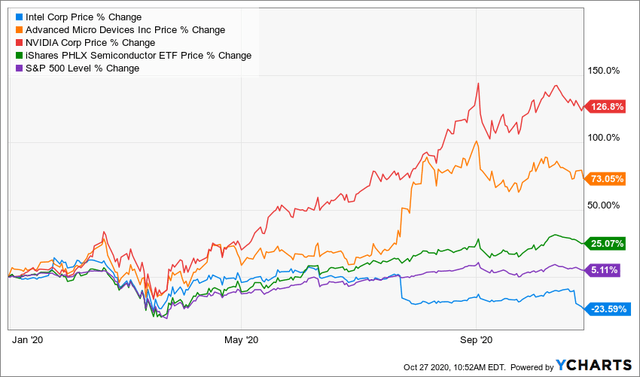

Intel (INTC) has been in trouble in the past few years. This year alone, the shares have dropped by ~23%, which is a significant underperformance compared to the S&P 500 and its peer companies. The stock has fallen by ~15% since it released its relatively decent quarterly earnings. In this report, I will explain why I have taken a small contrarian bet on the company.

Source: YCharts

Intel has been under pressure

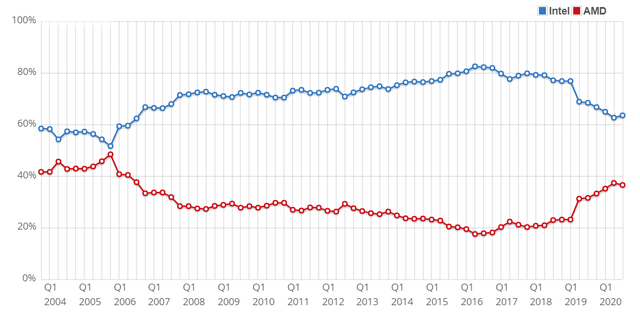

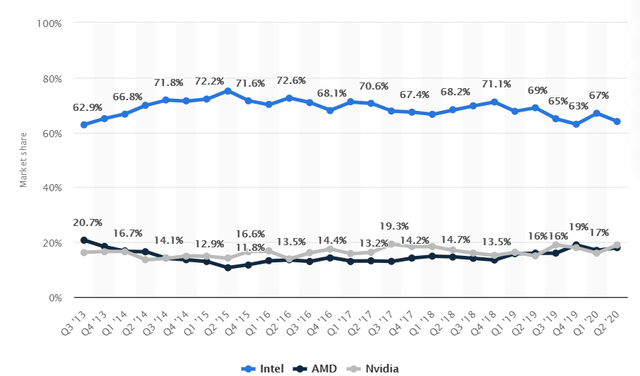

Intel has recently been under intense pressure as companies like Advanced Micro Devices (AMD) and Nvidia (NVDA) have accomplished more with less and taken a substantial market share. As shown below, in recent years, AMD's market share in CPUs has increased from ~17.6% in 2016 to the current ~36.5%. In the same period, Intel's share has dropped from ~82% to ~63.5%.

Intel's problems are well-known. The company is about to lose Apple (AAPL) as a key supplier of chipsets in a blow likely worth between $1.5 billion to $2.3 billion. The company has also delayed its anticipated 7nm chips to 2022. In contrast, Apple expects to launch its 5nm chips, which are equivalent to its 7nm in 2021. And, AMD launched its highly-popular 7nm chips in 2019.

Intel vs. AMD market share

Source: Passmark

Intel has also struggled in the GPU industry, where its market share has dropped from more than 70% in 2018 to the current 64%. In the same period, both AMD and Nvidia have seen a slight improvement in market share, according to data compiled by Statista. Worse, its market share in both CPUs and GPUs will continue falling as AMD and Nvidia integrate their Arm Holdings and Xilinx acquisitions.

Notably, Intel has underperformed its smaller peers even after spending significantly more money in R&D. In 2019,the firm spent more than $13 billion in R&D compared to AMD's $1.54 billion and Nvidia's $2.85 billion.

The impacts of Intel's problems were easily seen in the third quarter. The company's revenue declined by 4% year-on-year to $18.3 billion, mostly due to a 10% decline in the data-centric segment's 10% decline. Higher demand for PCs pushed revenue up by 1% to $9.8 billion. I expect that the PC revenue growth will start cooling since most people working from home have already purchased their computers.

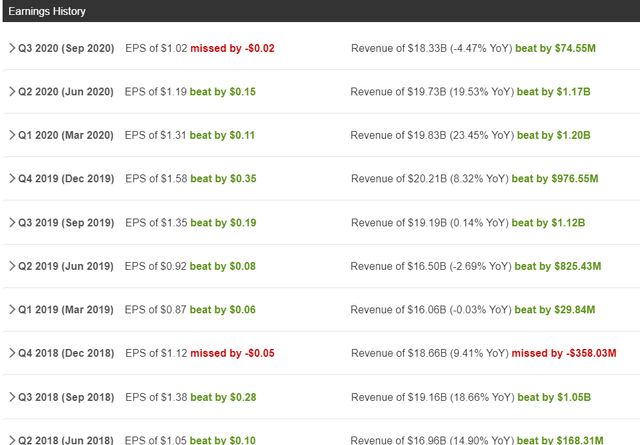

Most importantly, the company upgraded its Q4 revenue and EPS guidance to $75.3 billion and $4.90, respectively. It is worth noting that, as shown below, Intel has a relatively long track record of beating its and analysts' forecasts.

Intel tends to beat analysts' forecasts

Source: Seeking Alpha

However, while Intel's results were average, AMD's reported significantly better numbers. Its revenue jumped by 56% Y/Y as its computing and graphics segment rose by 22% to $1.49 billion. Also, its Enterprise, Embedded, and Semi-Custom revenue shot by 116%. This performance shows how fast the smaller company is growing.

Facing strong competition, Intel has decided to do what companies in its space do. Although it is still focused on innovation, the management has decided to focus more on financial engineering, like what IBM (IBM) did under Rometty.

The company has done the right thing and sold its loss-making NAND business for $9 billion. It has also put more emphasis on share buybacks and dividends. In Q3, the company accelerated its share repurchases to $10 billion as part of its $20 billion program.

Contrarian case for Intel

So, while Intel is facing significant challenges, I still believe that the company is a viable long-term investment for three primary reasons.

First, its dividend is backed by a strong payout ratio and a strong balance sheet. Intel has a dividend yield of 2.85%, which is above the overall S&P 500 average of ~1.75%. Remarkably, the company has a payout ratio - dividends relative to net income - of ~25%. This is better than the S&P 500 average of ~30%. Also, it has a long-term debt of ~$25 billion, which I expect will reduce after it completes its NAND transaction. So, Intel can easily sustain the current payouts and even increase, which is a good thing.

Second, while I agree that Intel is struggling on execution, the company has some bright spots. For example, its recently-launched 11th generation Intel Iris Xe graphics (Tiger Lake). These chips are built using nine new processors, and they feature Thunderbolt 4 support, Wi-Fi 6, and Xe integrated graphics.

Also, they are built on the 10nm platform, making them relatively faster than their ice lake predecessors. According to Intel, the chips offer 2.7% time for time creation and 20% faster office productivity. Indeed, demand for laptops sold using the processors has doubled since April. At the same time, more manufacturers are getting on board, with the company expecting ~100 designs by the end of the year.

So, while Intel has lost market share, I believe that the company has room to turn itself around, helped by its long reputation in the chip industry. Most importantly, as I wrote about IBM's role in cloud computing, I believe that more companies can still do well. For example, in the GPU market, we can see that while Intel's share has fallen, it remains significantly higher than AMD and Nvidia's share, combined. Most importantly, Intel's business has significantly higher margins than that of its peers.

Source: Statista

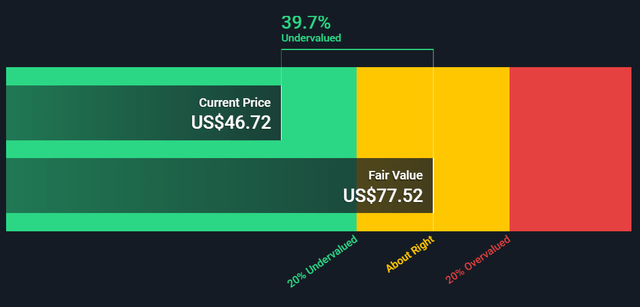

Third, I believe that Intel's stock is relatively undervalued. The company has a trailing price-to-earnings multiple of ~9.9. This is substantially lower than the average S&P 500 multiple of ~30. In comparison, companies like AMD and Nvidia have substantially higher multiple because of their relatively faster growth. Investing in undervalued stocks is not a sure way to beat the market.

However, Intel is not only undervalued, but it has some catalysts, including the opportunity in the Internet of Things (IoT), 5G, and higher data center demand. Compare a DCF valuation of the stock below, which implies a 20% upside from the current level.

Source: Simply Wall Street

Final thoughts

I have invested a small portion of my portfolio in Intel because I believe the company can still turn itself around. Indeed, the biggest tech firms, including Microsoft (MSFT) and Apple have gone through a similar phase. To be clear. There are risks in this investment, including accelerated market share loss and execution problems. Also, it still has political risks if the trade conflict between the US and China continue after the election.

Please note that I am also long AMD and Nvidia directly and through the iShares semiconductor ETF (SOXX)

Disclosure: I am/we are long INTC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The Link LonkOctober 29, 2020 at 11:51PM

https://ift.tt/34FRKOn

Intel Is Getting Squeezed - The Contrarian Case - Seeking Alpha

https://ift.tt/2YXg8Ic

Intel

No comments:

Post a Comment