When it came to the Q2 2020 earnings season, it's hard to argue against chip giant Intel (INTC) having the worst report in large cap tech. The stock dropped as the delay of 7nm products overshadowed strong results, as investors feared competitors like Advanced Micro Devices (AMD) would start to take important market share away. While shares have recovered some of their losses since, the upcoming Q3 report gives management a chance at redemption.

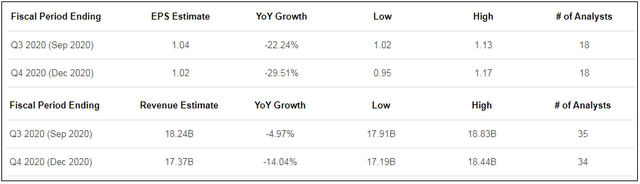

As a reminder, Intel management was looking for revenues of $18.2 billion and non-GAAP EPS of $1.10 in the third quarter. Both of those numbers were above street estimates for $17.94 billion and $1.08, respectively, at the Q2 report. In the graphic below, you can see where current estimates stand for that period as well as the current period we'll get guidance for.

(Source: Seeking Alpha analyst estimates page, seen here)

Intel has beat on the top and bottom lines in each of the past six quarters. In fact, the company has only announced one revenue miss in the last 13 periods, so investors will be looking for a good result in Q3. Obviously, Q4 guidance will be important for the short term, but I don't think it really changes the long term narrative here.

Had this been a normal year, I would have looked for management to give guidance for next year if things were looking good. With so many concerns about AMD stealing market share, good initial guidance for 2021 could have calmed down fears and reminded investors why Intel is the market leader. Unfortunately, the coronavirus situation likely means that we won't get any yearly guidance for 2021 until January at the earliest, and even then, it's not definite that we get a full year forecast. That means that redemption has to come through some other forms of information.

One of the main reasons that Intel shares stabilized in the past few months was that the company came out with a very unexpected piece of news. A $10 billion accelerated repurchase agreement was announced, which was going to lop off about 4% of outstanding shares right away. Beyond the help to earnings per share moving forward, it showed that the company believed its shares were undervalued. Also, the 8-K filing featured this statement:

Following completion of the ASR Agreements, Intel will have repurchased a total of approximately $17.6 billion in shares as part of the $20B Share Repurchase. Intel intends to complete the $2.4 billion balance of the $20B Share Repurchase and return to its historical capital return practices when markets stabilize.

We don't know at this point if Intel has returned to the open market since, or if it is still waiting for markets to be a bit calmer. However, the company would only be a quarter or two away from completing the total repurchase plan once it starts, so why not announce an increase in the current program or start a new one with this earnings report? Detailing more capital returns would certainly be a way to regain favor with shareholders.

Along the same lines, Intel could use the earnings report to raise its dividend. The last two raises have been announced in early January, so it's possible we don't see some news until then. However, the news could easily be detailed now, with the increase payout not starting until the normal annual cycle. With the accelerated buyback taking the share count down nicely, investors are surely looking for a dividend hike by early 2021 at the latest.

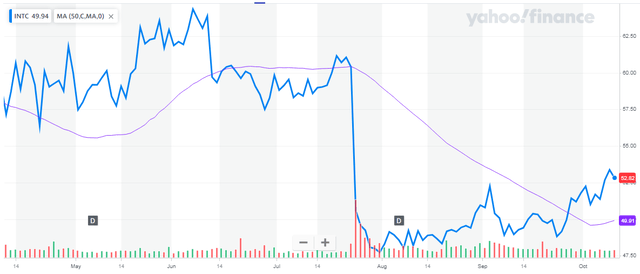

As for Intel shares, the chart below shows how they've recovered a bit of their post Q2 report losses. More importantly, shares have gotten back above the 50-day moving average, a key short term trend line, and they've stayed above it for more than just a day or two. A good Q3 report could keep this technical line rising, which would add support to the name and help continue the recent breakout. Analysts do see some upside in the stock, with the average price target being about $5 above Friday's closing price.

(Source: Yahoo! Finance)

When Intel reports its Q3 results next Thursday, the company will certainly be looking for redemption. Last quarter's report featured the 7nm delay that sent shares tumbling, and they still are well off their yearly highs. In a normal year, I would have thought management could detail guidance for 2021 if things were looking good, but that's likely not possible here. Perhaps we can see some major capital return updates to get shareholders excited instead, as good short term results may not be enough to satisfy investors.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

The Link LonkOctober 13, 2020 at 02:18AM

https://ift.tt/36VLrrv

Intel Looks For Redemption - Seeking Alpha

https://ift.tt/2YXg8Ic

Intel

No comments:

Post a Comment