Intel Corporation (INTC) is making a habit of this. The last three earnings reports have seen the stock fall in the afterhours. This has been in stark contrast to the actual top and bottom line results, which have for the most part, come in better than expected. We break down why the stock is struggling, where lies the bottom and how we plan to play it.

Q3-2020

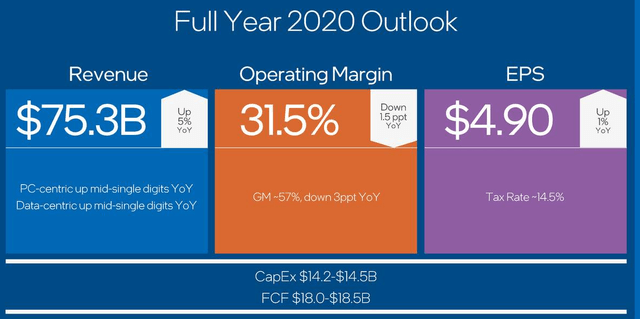

Intel's revenues came in at $18.3 billion, slightly ahead of consensus and earnings per share beat as well at a $1.11. The full year guidance was once again ahead of the analyst community.

Source: Intel Q3-2020 presentation

For Q4-2020, Intel is looking at a $1.11 versus consensus at a $1.06.

Source: Yahoo Finance

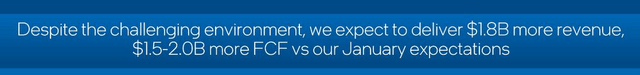

The Intel investor is obviously getting frustrated at what appears to be a marked disregard for the company's actual numbers. Intel's presentation slide sums this up nicely as the company is promising much larger free cash flow than what was expected at the start of the year.

Source: Intel Q3-2020 presentation

Where lies the problems

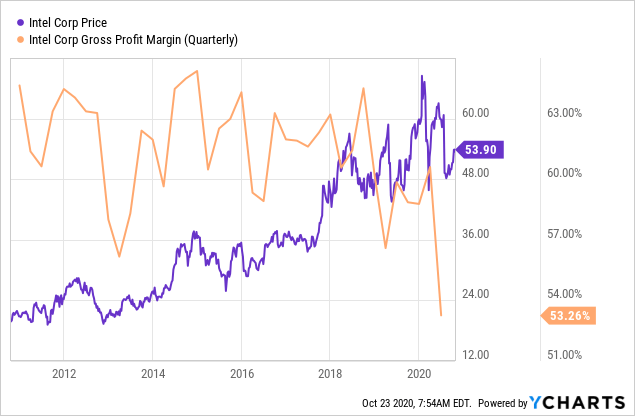

Intel's 7nm delays are beginning to bite its gross margins.

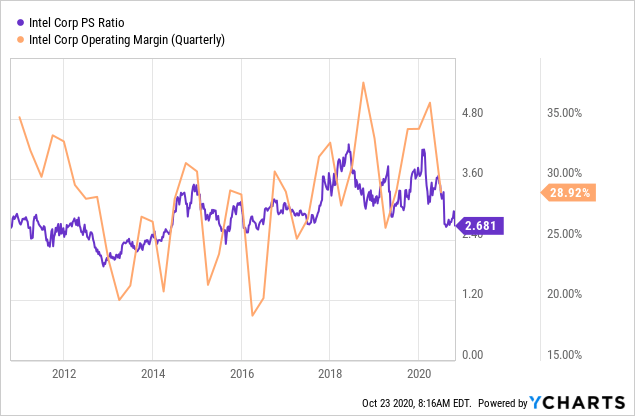

Data by YCharts

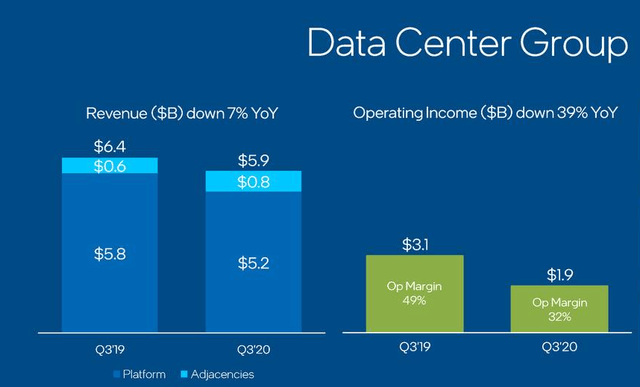

Data by YChartsQuarterly gross margins are now the lowest in 10 years. This had the biggest impact in the data center area where a small drop in revenues alongside a drop in gross margins, dropped operating income by 39%.

Source: Intel Q3-2020 presentation

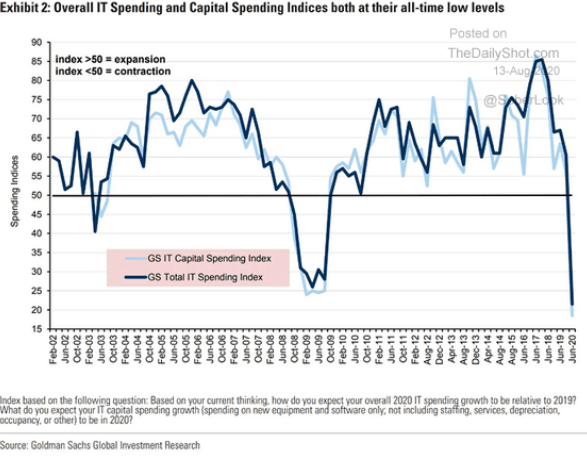

This clearly has the street worried about the impact on future cash flow. This trend is likely to be made worse by capex cutbacks. Back in August we shared the most important chart that technology bulls were ignoring.

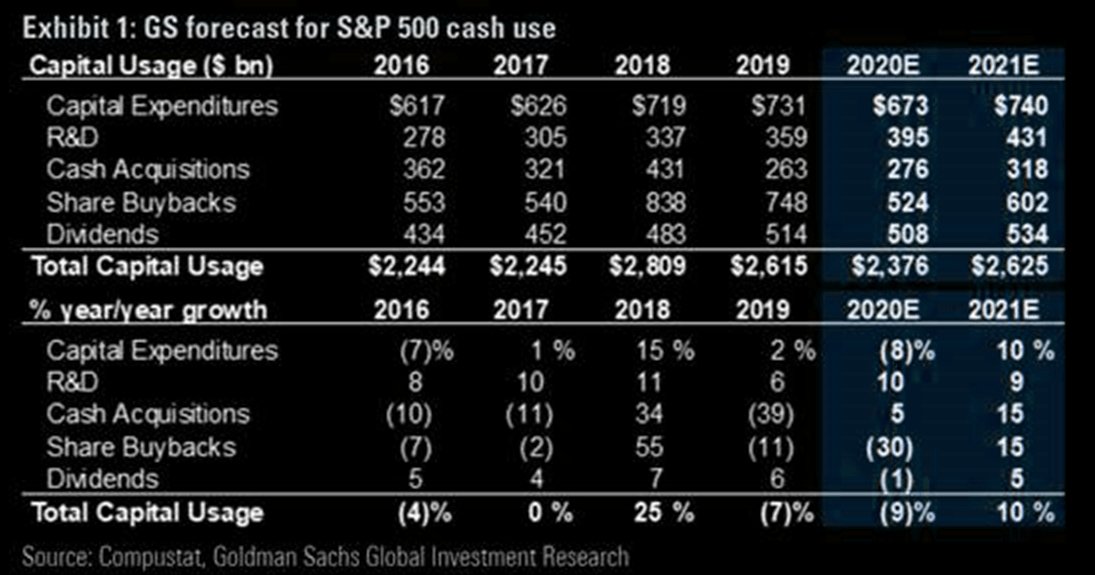

We did not see the impact in the second quarter, simply as there is a big lag between deciding to cut capex, and actually cutting capex. Goldman Sachs' (GS) latest outlook on overall capex has improved, but S&P 500 firms are still not ready to splurge.

Our Outlook For Intel

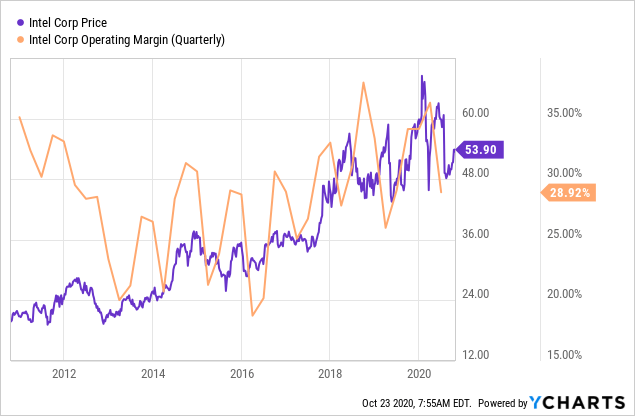

While Intel may be losing the gross margin battle, it has still held up its operating margins.

Data by YCharts

Data by YChartsQ4-2020 has operating margins forecasted at 26.5% and we don't think they will trough there. The battle for data center volumes is just beginning and the pressure will continue till at least Q1-2021. On a valuation basis you have to first decide if Intel can solve its 7nm problems which have been a continuing thorn in its side. If the answer is yes, and we believe it is, then the next step is figuring out a good buy point. How do we do that? Well, Intel's Price to Sales ratio is a good indicator to use as it strips out the noise of the change in margins. At 2.0x-2.4X sales we think we can buy and get the 10% annual total returns we target from companies. Assuming sales decline next year about 3-5%, we believe $40 represents a very good entry point.

Data by YCharts

Data by YChartsHow we played it last time

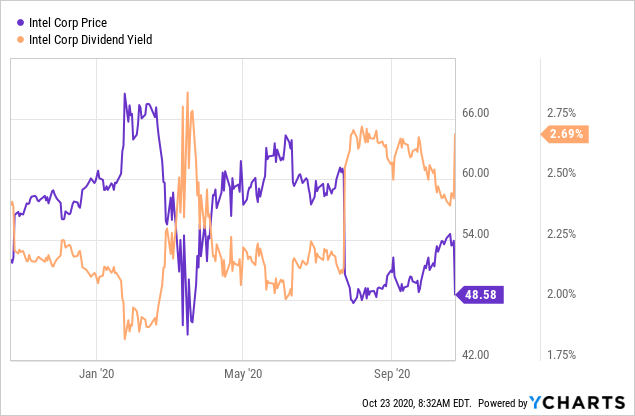

Investors are reluctant to let go of dividend paying securities and they are ready to hold through all the whipsaws. We get the allure of steady dividend stream, but we believe that the same or higher dividend stream can be created with a larger margin of safety. In the case of Intel, the current dividend yield while far more attractive than the 10 year Treasury Bond yield is hardly reason to stick your neck out.

Data by YCharts

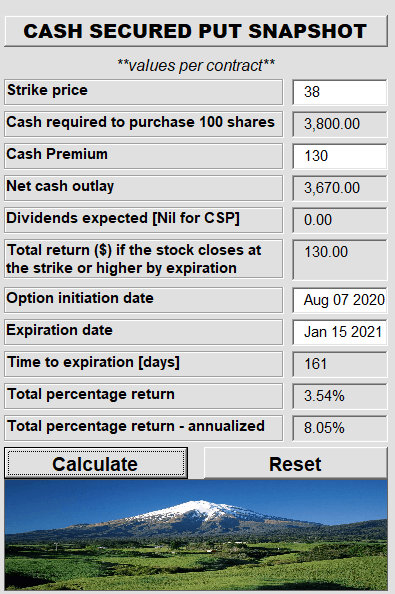

Data by YChartsOn the other hand, the high volatility of the stock alongside the fundamentals, make it a value at the right price. We bring this up as the last time Intel tanked, we were very happy to write cash secured puts to purchase this.  This trade was done on August 7 and offered us two things.

This trade was done on August 7 and offered us two things.

1) A very attractive entry point should the stock get there.

2) An annualized yield of almost 3X what the stock offered in dividends.

In general, we don't use such a high level of buffer to buy a stock but we have made such exceptions in a few cases including Intel and Southwest Airlines (LUV) where the price we found attractive, also offered a very substantial "yield".

How to Apply It Today

We still believe the $40 level could make a great buy point and investors should consider opportunities to sell cash secured puts around that level. The added uncertainty about elections is raising premiums even more than last time and you could get paid to wait, far more than we did. We are scanning the February-June timeframes for attractive options and will alert our subscribers once we find the right one.

Conclusion

In addition to Intel struggling to get the next generation of chips on the table, it will also face a very sluggish market in 2021. The work from home trend pulled forward demand into 2020 and revenue estimates from analysts are likely on the optimistic side.

Intel's margins are not yet done falling and competition for a more limited pool of data center capex dollars will get more intense. Both Advanced Micro Devices Inc. (AMD) and Nvidia Corporation (NVDA) are likely to capitalize on Intel's problems. When this cycle bottoms though, Intel will present a compelling long opportunity. This assumes that they fix their 7nm issues and our thinking at this point is that they will do just that. Intel certainly appears cheap relative to almost any other Technology stock, but there are some good reasons why that is happening. We are buyers in the sub $40 zone, but we want to be paid enough to wait for that opportunity.

If you enjoyed this article, please scroll up and click on the "Follow" button next to my name to not miss my future articles. If you did not like this article, please read it again, change your mind and then click on the "Follow" button next to my name to not miss my future articles.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility and outperform in bear markets?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Cash Secured Put and Covered Call Portfolios are designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

Learn more about our method & why it might be right for your portfolio. We are offering the next 20 subscribers a 20% discount to try our method risk-free!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We may initiate additional cash secured put trades.

The Link LonkOctober 24, 2020 at 08:00PM

https://ift.tt/2Tpp4m5

Intel: Margin Trough Will Mark Stock Bottom - Seeking Alpha

https://ift.tt/2YXg8Ic

Intel

No comments:

Post a Comment