Advanced Micro Devices (NASDAQ: AMD) is one of the largest semiconductor companies with a near $100 billion market capitalization. The company's share price has dropped 15% over the past month as the overall technology sector has continued to suffer. Now, the company has announced that it's revealing its new CPU and GPU in October. We discuss the importance of this reveal in this article.

Advanced Micro Devices - Wikipedia

Advanced Micro Devices' Zen 3

The first aspect of Advanced Micro Devices' new launch is the company's launch of its Zen 3 architecture on October 8, 2020.

These processors will be built on an improved 7 nm architecture from Taiwan Semiconductor (NYSE: TSM). However, combined with other architecture and process improvements, gains are expected to be in the range of 10-15% minimum. For TSM customers alone, the new node offers 10% power efficiency or 7% performance outside of any other improvements.

Across the board, these are significant performance opportunities. Initial framerate improvements indicate a 30% improvement over the 3800X versus the 5800X. More importantly, over the 10900K and its $530 MSRP (the CPU offers a 5% performance gain versus the 3800X $400 MSRP), the new CPU is expected to have a 25% gain over Intel's (NASDAQ: INTC) performance.

Despite the smaller node offering cost savings, the new node, even if it comes at the same price point, will offer dramatic performance improvements and higher margins. For those comparing it to Intel, it'll offer lower costs, better performance, and better power efficiency. These are all massive.

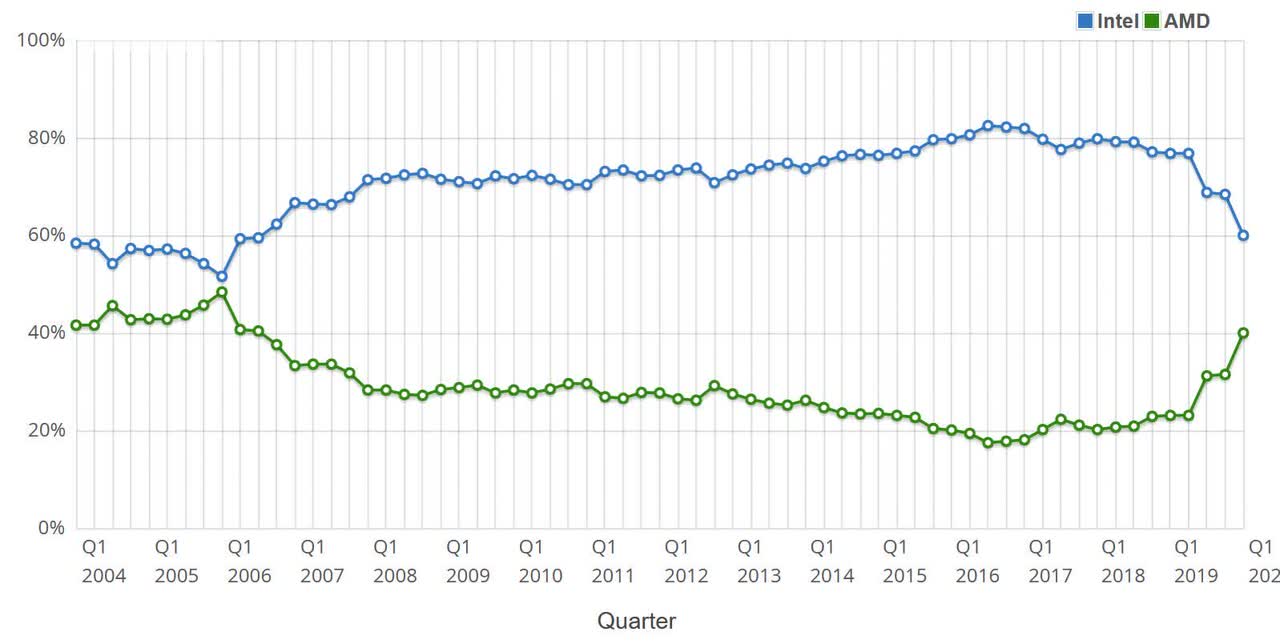

AMD vs. Intel Market Share - Wccftech

The above graph shows the market share comparison of Intel versus AMD. AMD's Ryzen processors have performed quite well and have been steadily capturing market share. Intel recently announced its "catch-up" with the 10xxx line of processors, however, the company has been plagued with supply issues making it difficult for the processors to stay near MSRP.

AMD has an opportunity to surpass Intel in performance, even outside of pricing. At the same time, the company can translate the same performance benefits to EPYC. That means the opportunity to expand in the much more lucrative server markets. Overall, this launch is about whether AMD can continue to dominate Intel.

Advanced Micro Devices' Big Navi

The next major upcoming launch for Advanced Micro Devices is its Big Navi GPU. The event of the company's next generation GPUs, also on TSM's 7 nm process, is expected to come on October 28.

Unfortunately, AMD hasn't been performing the same relative to Nvidia (NASDAQ: NVDA) compared to how it's been doing versus Nvidia. Nvidia doesn't own its own foundries so it doesn't suffer the same as Intel with its recent foundry issues that it's suffered. It's used Samsung's (OTC:SSNLF) 8nm process for its recent Ampere GPUs which have made the airwaves with their incredibly popular launch.

The company's last launch with the 2080, was the Radeon VII graphics card, at the same price with lower performance. Big Navi will solve some of that with its RDNA2 architecture including Ray Tracing and other significant benefits. Leaks have tipped Big Navi as being 40-50% faster than the 2080 TI. That's the same performance difference of the 3080 vs. 2080 TI.

The pricing has yet to be revealed, however, with stocking issues and AMD's Big Navi on a much more scaled node, there's a chance that it can be competitive at the same price. Nvidia still has nearly 3x the market share of AMD, which means that Big Navi doesn't need much success to compete, or outperform.

The Nvidia shortages, which could continue until 2021, could also make October and the GPU lunch a unique opportunity.

Advanced Micro Devices' Financial Positioning

On top of these launches, AMD is continuing to maintain an incredibly strong financial positioning.

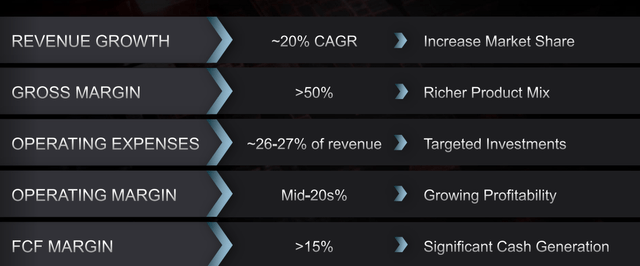

AMD Financial Positioning - AMD Investor Presentation

AMD is continuing with ~20% annual revenue growth with a gross margin of >50%. The company is maintaining operating expenses at roughly ~26-27% of revenue. That means an operating margin in the mid-20%'s. As the company moves to smaller and smaller silicon, it means the opportunity at the same price point to improve margins.

Putting this all together, the company expects an FCF margin >15%. Combined with continued revenue growth and the potential for improved margins and it stands to mean the company can become a cash flow giant. That cash flow will enable significant long-term shareholder rewards. The company has a triple-digit P/E ratio and a path to decrease that significantly.

Putting this all together, AMD is incredibly well-positioned financially for the massive month that October 2020 is expected to be.

Advanced Micro Devices' Risk

AMD's risk is through increased competition from its major hardware competitors. The company has managed to outperform Intel, however, the same was true in the late-2000s into the early 2010s. AMD lost its mantel, and Intel continues to be an incredibly large corporation filled with intelligent engineers.

The same could happen. The same is true of Nvidia, which released a peer-leading new GPU that caused major computing sites to have more traffic than Black Friday. These are risks that investors should continuously pay close attention to.

Conclusion

AMD has an impressive portfolio of assets and the company has continued to perform incredibly well. October is potentially the largest month in the company's history as the company announces whether it'll continue to hold its mantle versus Intel and whether its latest GPUs would be more competitive versus Nvidia.

That makes it, after the company's share price recovery these past years, potentially the largest month of the company's history. The company's financials have the potential to remain incredibly strong with improving margins and strong FCF yields. The company has minimal risk, but is a quality long-term investment.

The Energy Forum can help you generate high-yield income from a portfolio of quality-energy companies. Worldwide energy demand is growing and you can be a part of this exciting trend.

Also read about our newly launched "Income Portfolio," a non-sector-specific income portfolio.

The Energy Forum provides:

- Managed model portfolios to generate high-yield returns.

- Deep-dive research reports about quality investment opportunities.

- Macroeconomic market overviews.

Disclosure: I am/we are long AMD, INTC, NVDA, TSM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The Link LonkOctober 02, 2020 at 11:35AM

https://ift.tt/33iBHVY

Why October Is AMD's Most Important Month Ever - Seeking Alpha

https://ift.tt/2ZDueh5

AMD

No comments:

Post a Comment