MediaTek Inc. (TPE:2454) defied analyst predictions to release its third-quarter results, which were ahead of market expectations. The company beat expectations with revenues of NT$97b arriving 7.1% ahead of forecasts. Statutory earnings per share (EPS) were NT$8.42, 8.9% ahead of estimates. Earnings are an important time for investors, as they can track a company’s performance, look at what the analysts are forecasting for next year, and see if there’s been a change in sentiment towards the company. With this in mind, we’ve gathered the latest statutory forecasts to see what the analysts are expecting for next year.

Check out our latest analysis for MediaTek

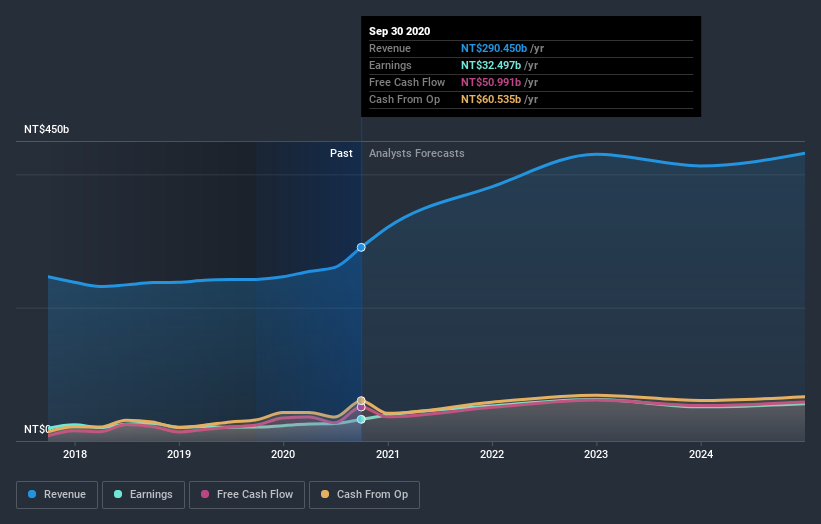

Taking into account the latest results, the consensus forecast from MediaTek’s 23 analysts is for revenues of NT$381.2b in 2021, which would reflect a substantial 31% improvement in sales compared to the last 12 months. Per-share earnings are expected to jump 61% to NT$33.33. In the lead-up to this report, the analysts had been modelling revenues of NT$373.0b and earnings per share (EPS) of NT$32.71 in 2021. So it looks like there’s been no major change in sentiment following the latest results, although the analysts have made a small increase to to revenue forecasts.

It may not be a surprise to see thatthe analysts have reconfirmed their price target of NT$806, implying that the uplift in sales is not expected to greatly contribute to MediaTek’s valuation in the near term. The consensus price target is just an average of individual analyst targets, so – it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values MediaTek at NT$1,200 per share, while the most bearish prices it at NT$520. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It’s clear from the latest estimates that MediaTek’s rate of growth is expected to accelerate meaningfully, with the forecast 31% revenue growth noticeably faster than its historical growth of 2.0%p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 10% next year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect MediaTek to grow faster than the wider industry.

The Bottom Line

The most obvious conclusion is that there’s been no major change in the business’ prospects in recent times, with the analysts holding their earnings forecasts steady, in line with previous estimates. Happily, they also upgraded their revenue estimates, and are forecasting revenues to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have forecasts for MediaTek going out to 2024, and you can see them free on our platform here.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

Promoted

When trading MediaTek or any other investment, use the platform considered by many to be the Professional’s Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

The easiest way to discover new investment ideas

Save hours of research when discovering your next investment with Simply Wall St. Looking for companies potentially undervalued based on their future cash flows? Or maybe you’re looking for sustainable dividend payers or high growth potential stocks. Customise your search to easily find new investment opportunities that match your investment goals. And the best thing about it? It’s FREE. Click here to learn more.November 04, 2020 at 05:24AM

https://ift.tt/3kVyzpi

MediaTek Inc. Just Beat Analyst Forecasts, And Analysts Have Been Updating Their Predictions - Simply Wall St

https://ift.tt/3e1uOdC

Mediatek

No comments:

Post a Comment