In a Real Money column Wednesday, Jim Cramer recommended investors focus on individual semiconductor stocks, and stay away from ETF baskets. Some semiconductor names he favored included Qualcomm (QCOM) and Advanced Micro Devices (AMD) .

I haven't looked at AMD in some time so let's check it out now. On Oct. 28 I was too bearish and recommended, "Despite the fundamental story, the charts of AMD suggest a fair amount of risk ahead. Take profits on longs and avoid the long side for now."

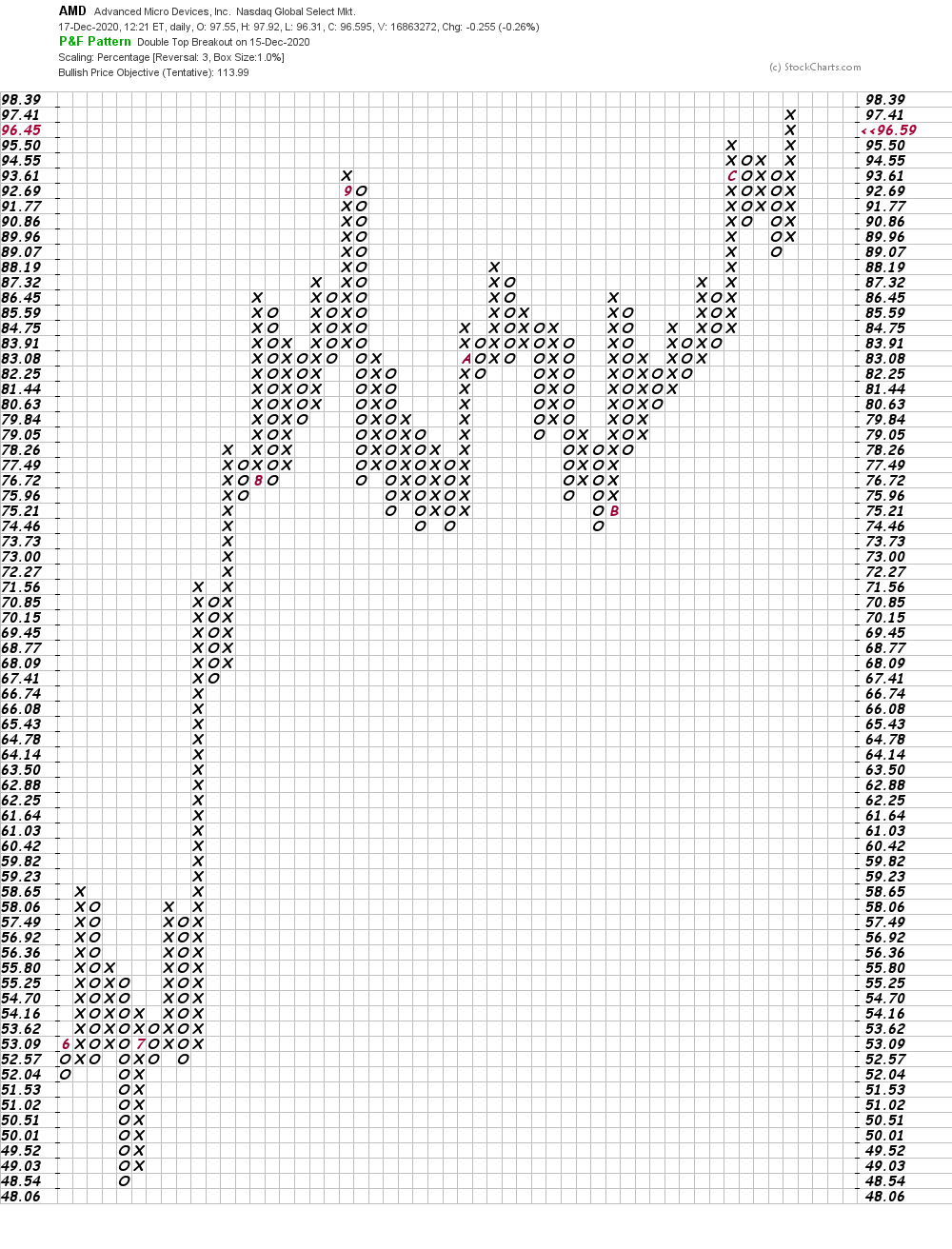

The shares dipped a little further into early November but never broke the September lows to start a downtrend (see the chart below). Prices zigzagged up to the October high and broke out higher earlier this month.

In the daily bar chart of AMD, below, we can see that the shares have even broken out over the September highs. AMD is trading above the cresting 50-day moving average line and nicely above the rising 200-day moving average line. The trading volume has been steady and the On-Balance-Volume (OBV) line has inched upward the past two months but it has yet to make a new all-time high to confirm the price breakout.

The Moving Average Convergence Divergence (MACD) oscillator is pointed up and above the zero line but the two average lines are on top of each other.

December 18, 2020 at 02:00AM

https://ift.tt/2Ws00fL

Can We Get the Next Move in AMD Right? - RealMoney

https://ift.tt/2ZDueh5

AMD

No comments:

Post a Comment