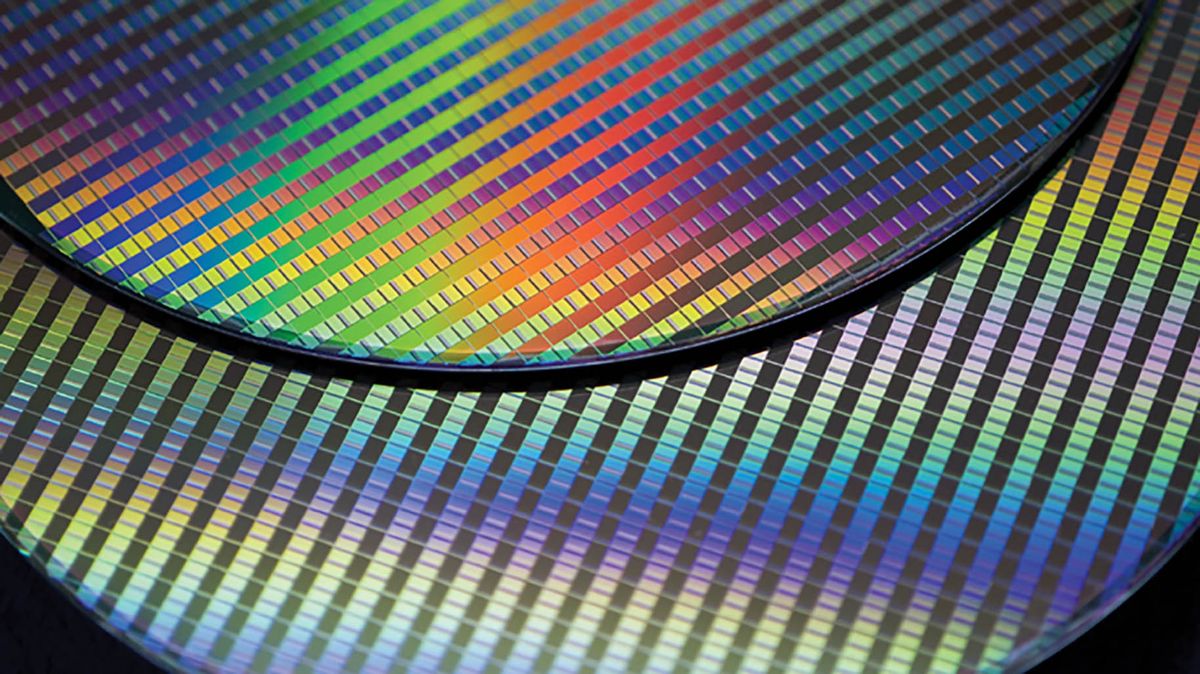

TSMC, one of the leading chipmaking foundries in the world, is reportedly set to cut discounts for its 12-inch fab customers in response to high demand and increasing prices from rival foundries.

TSMC has ties to most companies that manufacture logic for our PCs, and so word of a price increase during a time when supply is incredibly tight for any and all PC hardware has our hair standing on end. But we're cautiously optimistic that any price increases won't have too great an impact on our hobby.

The fact that advanced process nodes, such as 7nm and 5nm, are in such high demand is nothing out of the ordinary. With so few viable alternatives to TSMC—Samsung is perhaps the only other option for cutting-edge silicon—companies without fabs are essentially at the mercy of foundries to set their own prices.

According to a report from the Taiwanese Central News Agency (via Tom's Hardware), TSMC may be looking to adjust the discounts it offers it largest customers, which are said to currently reduce wafer manufacturing costs by up to 3%. That could have a knock-on effect for pricing further down the supply chain, but it's difficult to say much more as TSMC refuses to comment on pricing or supply.

Many companies familiar to PC gamers are clients of TSMC, too. I already mentioned AMD, who uses the foundry for all but its I/O chips (manufactured instead by GlobalFoundries). Apple is also a major client of TSMC's latest process nodes, nowadays that's the 5nm process, while smaller businesses that make controllers, chipsets, and logic for our gaming PCs (there's a lot of that, too) often use TSMC to build them.

Nvidia's Turing GPUs were built on TSMC technology. However, it has since switched to Samsung's 8nm process for at least the RTX 30-series high-end chips. Intel is a different kettle of fish entirely, operating its own manufacturing facilities. But that comes with its own burdens. It is also tapping TSMC for wafers in 2021, so is not without some ties to the Taiwanese manufacturing giant.

TSMC is not the only one reportedly increasing prices, however. As the report states, smaller foundries such as UMC, World Advanced, and Power Semiconductor Manufacturing Co. will be increasing prices due to high demand, which indicates the overall cost to manufacture chips could increase. It is a seller's market, after all.

But there's little reason to worry just yet. The reported discounts are only said to ease into 2021, and we've no confirmation of which companies that could affect. We don't even know what sort of discount AMD is enjoying, as both companies (obviously) won't talk about it.

Best focus on actually finding stock available before worrying about marginal price increases, eh?

The Link LonkDecember 16, 2020 at 07:51PM

https://ift.tt/3an8Cg9

Chip manufacturing costs could be rising for AMD, but finding stock should be your only concern - PC Gamer

https://ift.tt/2ZDueh5

AMD

No comments:

Post a Comment