As a gap trader, I see gaps as entry opportunities. Sometimes, it is on the long side and sometimes, it is on the short side. But the rarest of gap opportunities are on stocks with high liquidity, as the high liquidity of such stocks, typically, means that every price has a buyer.

So, when Intel (INTC) gapped down today, I took an interest. Gaps on news are the hardest gaps to play because these gaps have clear news-based reasons. Intel's gap was likely due to Microsoft (MSFT) announcing that it will, like Apple (AAPL), begin producing its own chips. We have two things to discuss here: the gap and the news.

The Gap

INTC's gaps of significant movement are hard to guess just from the charts. While small gaps are - like in other stocks' charts - usually area gaps, those on news are not so predictable. For example, the last significant gap was an area gap, while the one before it was a breakaway gap:

(Source: Stockcharts)

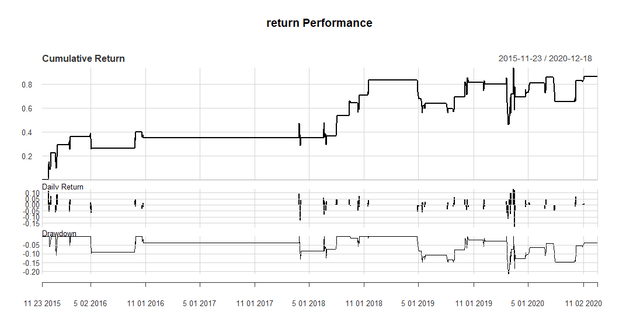

I've spent years developing my gap trading to the point that I have a backup algorithm I run as a form of predicting the direction of a stock post-gap. For this particular gap type, I've found the gap to be an area gap and thus should fill for INTC. Here is the result of my backtest on this sort of gap over the past five years, assuming you buy the stock immediately after the gap (on market open Dec. 22), a hold for three days:

(Source: Damon Verial; data from Tiingo)

Clearly, this sort of gap is more likely an area gap than a breakaway gap but not to a consistently nice level. However, the upside vs. downside generally makes such a gap a worthy buy-in opportunity for INTC, at least for the short term. Generally, this means that selloffs in a stock are overdone.

Another way to put it is that investors overreact to bad news. You can see that Friday - the day before the gap - also gave way to a large amount of selling. The gap that occurred on Dec 21 is what I call an "amateur gap": when less-seasoned traders react to the price action driven by more seasoned pros, leading to oversoldness in the stock, an oversoldness that usually reverts.

Anyway, that's the gap. It looks like an overreaction and a buy-in opportunity for short-term traders and for long-term investors looking for relative bottoms or "discounts." The relatively low volume on the day of the gap is also a pretty good indication that the gap will close.

The News

Now that we are done with the technical, short-term stuff, let's talk about the actual news, which is much more relevant to the long-term investors of INTC. My general thesis on Intel is that the company has gotten too comfortable with its lead in the industry. As I stated in my last article, the company has become scarcity-driven and almost entirely focused on maintaining the products that currently have large/majority market share instead of innovating (the action that initially brought Intel to the forefront of the tech environment).

Intel has over-relied on x86 being the market staple to the point of causing its chip development to constipate. Apple, Alphabet (GOOG), and MSFT are justifiably feeling as though they are hostage to a stagnating partner who cannot progress and update at speeds or innovativeness that match their own levels. While Intel has sat on its throne, it has let the once court jester Advanced Micro Devices (AMD) gain enough power to potentially usurp the king.

But perhaps we cannot blame Intel alone. Microsoft's shift toward in-house chip manufacturing seems to be part of a trend. Big tech companies are all drifting toward a vertical structure in which only their hardware works with their software.

Even if Intel is blameless here, we still need to worry about the future of Intel. Intel's revenue streams will be stifled in a new tech environment in which the major players no longer outsource chip development to Intel (or AMD). Intel would need to pivot to maintain relevance, but as I've written previously, Intel is too big, old, dumb, and slow to pivot in the modern age of technology - its business strategy at this time is more defensive, attempting to maintain the hold it has over the industry in spite of rapidly advancing trends.

Microsoft, as the producer of the leading OS, moving into the chip market will effectively supplant Intel for many PC manufacturers. If Microsoft produces a chip specifically designed to work with Windows, companies such as HP (HPQ) and Dell (DELL) will find themselves motivated to ship PCs with Microsoft chips. That motivation will not only be from Microsoft itself but also from consumers who certainly would benefit from and demand the integration between Microsoft's OS and its chips built specifically to run Windows.

Even worse, Microsoft having vertical control of its software/hardware production could lead to OS features that are exclusively available for machines running Microsoft chips. Microsoft would not need to run a competitive campaign against Intel to win; the competitive advantage would be within the design of the chip/OS integration. Between AMD producing superior chips and Microsoft pushing competing chip manufacturers out of Windows machines, Intel sees its previous hold on the CPU industry shrinking. Even Amazon (AMZN) has stepped away from Intel in its data center segment. It is as if the whole industry is against Intel. But we know that technology is less of a game of business agreements and more of a game of progression: Were Intel like Nvidia (NVDA), it would have a competitive advantage either too good or too expensive to compete with, thus maintaining its hold on the industry, and even taking on a giant such as Apple.

But Intel is not Nvidia. Intel used to be like Nvidia in that it was the only reasonable chip fab for US companies. However, Intel's clients in the tech have too many alternatives, from outsourcing fabrication to Taiwan to using their stockpiles of cash to just do it themselves.

Intel simply hasn't incentivized the industry to continue buying. Too focused on maintaining a lead in architecture (vs. ARM) and industry (vs. AMD), Intel is much like a king intent on maintaining his power instead of improving his kingdom. Now, his subjects are fed-up and rebelling.

Microsoft's foray into the chip market is likely the final curtain for Intel. With Apple already out of the picture, Microsoft was to Intel as a host is to a parasite. Intel overstayed its welcome without innovating and will one day be an important example to business students studying the death of companies in universities across the world - a worthy legacy.

The Trade and Its Risk

You can short INTC if you're daring enough, but realize a short position exposes you to unlimited upside risk. If you want to cap the risk involved in shorting INTC, you can buy protective calls each week as needed. Here is one such play:

- For every 100 shares shore INTC

- Buy 1 weekly ATM call option

This is like shorting but hedged. You still gain the same downside benefit should INTC fall but without the risk of outright shorting the stock. Ensure you roll over the calls weekly so as to not take on the upside risk of shorting.

To clarify, this strategy exposes you to the potential gains if INTC downward but caps your net potential loss via the long call option. You get nearly unlimited potential gain at a capped potential loss. The only downside here is the cost of the call, but this is a cost you can control by changing the strike price at which you purchase.

These risks are unrelated to macroeconomic factors. However, if you wish to hedge the play on INTC specifically to macroeconomic factors, you can run a pair trade. That is, go long tech through an ETF, such as via the Invesco QQQ Trust (QQQ), while you are short INTC.

If you have questions regarding this strategy, let me know in the comments section below (or chat room, if a member).

Exposing Earnings is an earnings-trading newsletter (with live chat). We base our predictions on statistics, probability, and backtests. Trades are recommended with option strategies for the sake of creating high-reward, low-risk plays. We have 89% accuracy for our predictions in 2019.

-Upcoming Earnings Plays: AZO, ORCL, MU, CAMP, LQDT

Check out my methodologies in these four videos.

If you want:

- A definitive answer on which way a stock will go on earnings...

- The probability of the prediction paying off...

- The risk/reward of the play...

- A well-designed options strategy for the play...

...click here to see what Exposing Earnings members are saying.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The Link LonkDecember 24, 2020 at 12:34AM

https://ift.tt/2WGhzsJ

Intel Is Finished - Seeking Alpha

https://ift.tt/2YXg8Ic

Intel

No comments:

Post a Comment