Like other tech stocks, Advanced Micro Devices (AMD) - Get Report hasn't fared too well lately.

Although it’s held up better than some of its high-growth peers, AMD hasn’t been immune to the decline in tech stocks.

While higher interest rates have been the blame, the entire tech space has been struggling. Shares of AMD fell 25.5% from peak to their recent trough, which is about in-line with Nvidia’s (NVDA) - Get Report recent slide.

I liked Nvidia on the dip and because both companies have great fundamentals I like AMD on the dip too.

So far, shares have been rallying nicely off last week’s low. Let’s take a closer look at the chart to see what the damage is.

AMD and Nvidia are holdings in Jim Cramer's Action Alerts PLUS member club. Want to be alerted before Jim Cramer buys or sells AMD or Nvidia? Learn more now.

Trading AMD

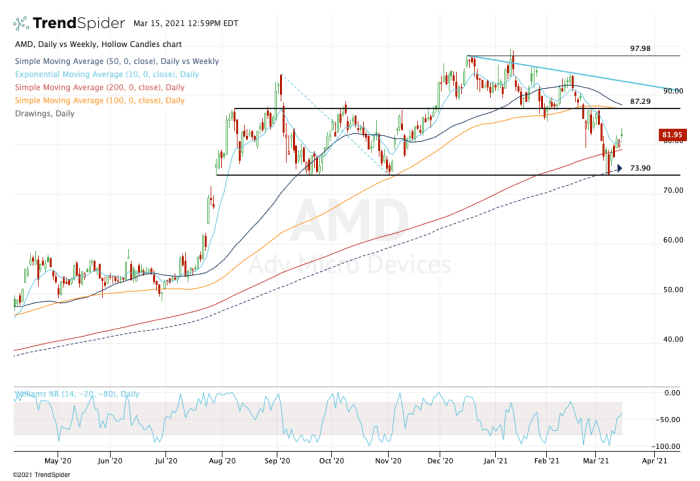

Earlier in the year, AMD looked set to test $100 and potentially break out over this mark.

Instead, it kept finding sellers on each rally, even as the $87 level was acting as support along with the 100-day moving average.

Ultimately these levels failed as support, with shares flushing down to the 200-day moving average.

It wasn’t necessarily wrong for investors to expect the 200-day moving average to be support. However, with rising interest rates driving the narrative, tech stocks were under heavy pressure.

Once this level failed for AMD, it looked dicey. That is, unless you were looking at multiple timeframes.

AMD stock traded down perfectly to range support near $74, as well as the 50-week moving average. It bounced from this level on Friday March 5th and closed at it on Monday March 8th. Since then, it’s been enjoying a strong rally.

From here, we have to see how the stock handles its 100-day moving average and the $87 level. These prior measures were support. If they are reclaimed, they can again act as support.

However, if they are resistance, AMD stock may need more time to consolidate.

On the downside, let’s see if shares can stay above the 200-day moving average. If the stock can do so, it’s likely a buyable dip. Below it puts the 50-week moving average in play.

Even though I don't know if $78 or $88 is next, I like AMD stock for the long term. It has too many catalysts to ignore.

The Link LonkMarch 16, 2021 at 01:15AM

https://ift.tt/30KH2mH

AMD Is a Stock to Buy on the Dip - Here’s Why - TheStreet

https://ift.tt/2ZDueh5

AMD

No comments:

Post a Comment