POLAND - 2021/02/19: In this photo illustration an AMD logo seen displayed on a smartphone with ... [+]

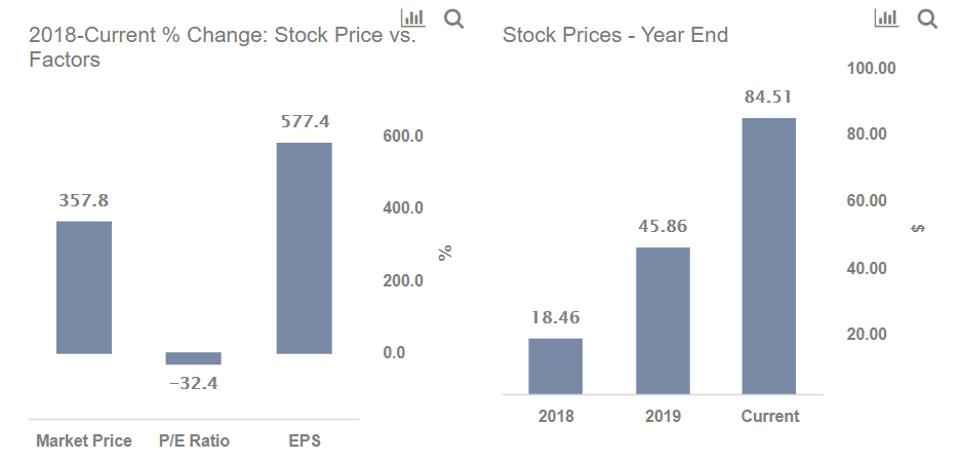

SOPA Images/LightRocket via Getty ImagesDespite already rising more than 2x from its low in March 2020, at the current price of $84 per share, we believe Advanced Micro Devices stock (NASDAQ NDAQ : AMD) has further upside potential. AMD stock has increased from $39 to $84 off the recent bottom, much more than the S&P which increased by around 70% from its lows. Further, the stock is up around 50% from the level it was at before the pandemic. However, we believe that AMD stock could jump to fresh highs, rising around 20% to cross its all-time high of $99, driven by expectations of strong demand and strong full-year 2020 results despite the pandemic. Our dashboard What Factors Drove 350% Change In Advanced Micro Devices Stock Between 2018 And Now? has the underlying numbers behind our thinking.

The stock price rise since 2018-end came due to a 45% jump in revenue from $6.7 billion in FY 2019 to $9.8 billion in FY 2020. Further, net margins shot up from 5.1% to 25.5%, driving a 6x rise in EPS from $0.31 in FY 2019 to $2.10 in FY 2020, despite an 8% rise in the outstanding share count.

AMD’s P/E (price-to-earnings) multiple dropped from 60x in 2018 to 22x by 2019 end, but has since jumped to 40x, riding the rally in technology stocks. We believe that the company’s P/E ratio has the potential to rise further in the near term on expectations of continuing demand growth and a favorable shareholder return policy, thus driving the stock price higher.

Where Is The Stock Headed?

The global spread of coronavirus and the resulting lockdowns in early 2020 affected semiconductor demand and industrial activities. However, rising gaming and computing device demand, combined with growing demand for data centers, meant that AMD benefited strongly during the pandemic. This is evident from AMD’s full-year 2020 earnings, where revenue grew almost 1.5x from $6.7 billion in FY 2019 to $9.8 billion in FY 2020. As operating expenses didn’t grow at the same rate as revenue, pre-tax income rose almost 3.5x from $372 million to $1.28 billion. Further, a $1.2 billion tax benefit compared to a $31 million tax expense in 2019, meant that EPS grew a staggering almost 7x from $0.31 to $2.10. Even discounting the tax benefit, and assuming a tax rate similar to that in 2019, EPS would have still jumped more than 3x in FY ’20.

MORE FOR YOU

Additionally, with the lockdowns being lifted and manufacturing capacity stepping up to pre-Covid levels, we believe the company will see further revenue and margin growth in the medium term. These factors will raise investor expectations further, driving up the company’s P/E multiple. We believe that Advanced Micro Devices AMD stock can rise around 20% from current levels, to set fresh highs over $99.

While Advanced Micro Devices stock does seem attractive, 2020 has created many pricing discontinuities which can offer further trading opportunities. For example, you’ll be surprised how the stock valuation for Activision Blizzard vs. D.R. Horton shows a disconnect with their relative operational growth. You can find many such discontinuous pairs here.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams

The Link LonkMarch 02, 2021 at 10:00PM

https://ift.tt/3sLMKRx

Strong Earnings Could Drive AMD Stock To Fresh Highs - Forbes

https://ift.tt/2ZDueh5

AMD

No comments:

Post a Comment