Exactly one week after new Chief Executive Pat Gelsinger unveiled plans to reinvent Intel Corp., Arm Ltd. announced version 9 of its architecture and put forth its vision for the next decade. We believe Arm’s direction is strong and compelling as it combines an end-to-end capability, from edge to cloud to the data center to the home and everything in between.

Moreover, it doubles down on Arm’s model of enabling ecosystem partners to add significant value while at the same time maintaining software compatibility with previous generations. We see this as extremely important because the variety of use cases requiring specialized silicon is rapidly expanding in the marketplace, and the Arm architecture is by far in our view the best-positioned to capitalize on this coming wave.

In this Breaking Analysis, we’ll explain why we think this announcement is so important and what it means for Intel and the broader technology landscape. We’ll also share with you some feedback we received from theCUBE community on last week’s episode and a little inside baseball on how Intel, IBM Corp., Samsung Electronics Co. Ltd., Taiwan Semiconductor Manufacturing Co. Ltd. and the U.S. government might be thinking about the shifting landscape of semiconductor technology.

Competitive responses to Intel’s IDM 2.0

Intel’s announcement comprised three broad pillars: 1) sticking to its internal factory network strategy; 2) increasing its use of outside foundries and 3) launching a new quasi-independent foundry business unit.

This past week there were two notable announcements directly related to Intel’s new direction: the Armv9 news and TSMC’s plans to invest $100 billion in chip manufacturing and development over the next three years.

That’s a big number and appears to trump Intel’s planned $20 billion investment to launch two new fabs in the U.S. starting in 2024. You may remember back in 2019, Samsung pledged to invest $116 billion to diversify its production beyond memory chips.

Why the rush to spend and will it cause an oversupply?

Why are all these companies getting so aggressive, and won’t this cause a glut in chips? First, China looms large and aims to dominate its local markets, which in turn will confer advantages globally. Second, there’s a huge chip shortage right now and the belief is that it will continue through the decade and possibly beyond. We are seeing a new inflection point in demand, as we discussed last week, stemming from digital, the “internet of things,” cloud, autos and new use cases in the home.

As to the glut, these manufacturers believe that demand will outstrip supply indefinitely and they understand that a lack of manufacturing capacity is more injurious than an oversupply. If there’s overcapacity in the market, manufacturers can cut production and take the financial hit. By contrast, capacity constraints mean you can miss entire cycles of growth and completely miss markets along with the resulting benefits of volume learning curves and cost reductions. So they’re all going for it, hard.

What Arm announced and why it’s so compelling

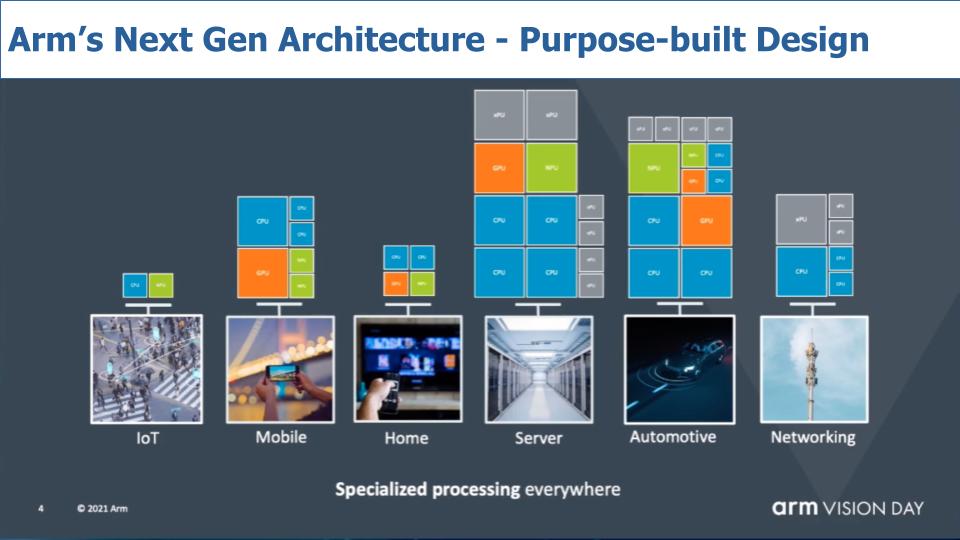

A key element of Intel’s new strategy was Pat Gelsinger’s vision of system on package. This is an attempt to leapfrog system on chip or SoC. In a bold architectural move, Arm is taking a similar systems approach. However, in our view it’s even broader than the vision laid out by Pat. Arm is targeting a wide variety of use cases, as shown below.

Arm’s fundamental philosophy is that the future will require highly specialized chips. And Intel, as you recall from Pat’s announcement, would agree. The difference is that Arm has been executing on a strategy that allows for flexible customization and value-add by ecosystem partners for decades. Intel is just now finally acting to take advantage of the future – but the future is here now and Intel won’t be ready for years.

Comparing the Arm and Intel models

Arm historically has taken an ecosystem approach that is far different from Intel’s model. Arm is all about enabling the production of specialized chips to fit the application. For example, think about the amount of artificial intelligence going on in iPhones moving from fingerprint to face recognition. This required specialized neural processing units or NPUs that are designed by Apple Inc. for the specific use case. Arm is facilitating the creation of these specialized chips to be designed and produced by the ecosystem.

Intel, on the other hand, has historically taken a one-size-fits-all approach, built around the x86. Intel’s design has always been about improving the processor in terms of speed, density, adding vector processing to accommodate AI and the like. And Intel does all the design and manufacturing and any specialization required by ecosystem. Intel has been a value-sucking machine, putting as much function into its chips as it saw profitable, leaving less value-add for ecosystem partners.

For example, think about personal computers and servers, Intel’s biggest markets. Much of the value-add from customers such as Dell Technologies Inc., Lenovo Group Ltd., HP Inc. and Hewlett Packard Enterprise Co. has frankly been bending metal or adding displays or other features at the margin. It’s true that storage and networking vendors have been able to add more value, but those markets are much smaller than PCs and servers. For the most part, Intel has been the big winner in hardware and left its original equipment manufacturer customers to live in a world of relentless consolidation and margin pressure.

Nonetheless, the big advantage Intel and its ecosystem has enjoyed is that the x86 architecture is well-understood and reliable, and most enterprise software runs on x86. So this has been particularly lucrative for software companies such as Microsoft Corp. and VMware Inc., which realize most of their value-add by writing code that works extremely well on x86. And having a consistent, stable processor platform is a bonus that has supported massive growth in software markets.

So as you can see, Arm and Intel have historically had very different models, which we heard Gelsinger say last week when he vowed to change with its new trusted-foundry strategy.

The problem is that the vast majority of Intel’s operations are serving a business model that is losing momentum at the macro level.

Arm’s approach is well-suited for the future

Let’s go through an example that will help further explain the power of Arm’s model.

Take Amazon Web Services Inc. developing its own Graviton chips. Or think about Apple designing the M1 chip. Or Tesla Inc. designing its own chip. Or any other company in one of these use cases shown in the graphic above.

The Tesla case study is instructive. In order to optimize for video processing, Tesla needed to add firmware in the NPU for its specific use case that involved processing video. It was happy to take off-the-shelf central processing units or graphics processing units and components of the Arm architecture — as is — and leverage Arm’s standards. But Tesla saw an opportunity to add its own value in the NPU. The advantage of this model is Tesla could get to tape out in less than a year, versus taking many years with traditional models.

Arm is like customizable LEGO blocks that enable unique value-add by ecosystem partners with much faster time to market. Tesla goes from tape out (logical tape out, if you will) to Samsung and say, “OK, run this against your manufacturing process,” and it should all work as advertised. Tesla interestingly chose the 14-nanometer process to keep costs down – it didn’t need the latest and greatest density. It was all about the flexibility to fit the application and time to market.

Based on Gelsinger’s announcement, Intel is vectoring toward the Arm model for its foundry business. It has to do so. But as we pointed out last week, foundry is a very different business with different margin models, relationships, go-to-market strategies — and, very importantly, volume requirements.

Assessing Armv9

What’s so special about Armv9?

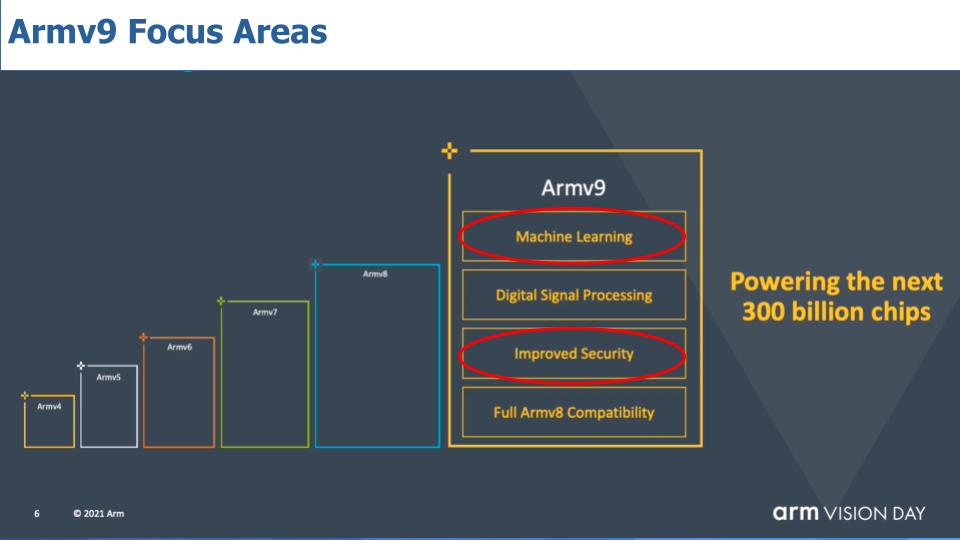

Armv9 is backward-compatible with previous generations. Perhaps Arm learned from Intel’s failed Itanium effort where it had no backward compatibility and floundered. As well, Arm adds some additional capabilities. In this post we’re going to focus on the two areas highlighted in red, the machine learning piece and security.

Take note of the call-out: 300 billion chips. That’s a lot and we’ve said Arm wafer volumes are 10 times those of x86. Volume means cost reduction and is critical to the foundry business. We’ll come back to that later.

Betting on AI and ML: The trend is your friend

A key component of the Armv9 architecture is its Scalable Vector Extension 2 or SVE2, designed to deliver more granular data parallelism and enable more work per instruction. This will support increasingly robust machine learning applications across a variety of use cases such as language processing, visualization, dynamic pricing, fraud detection and the like.

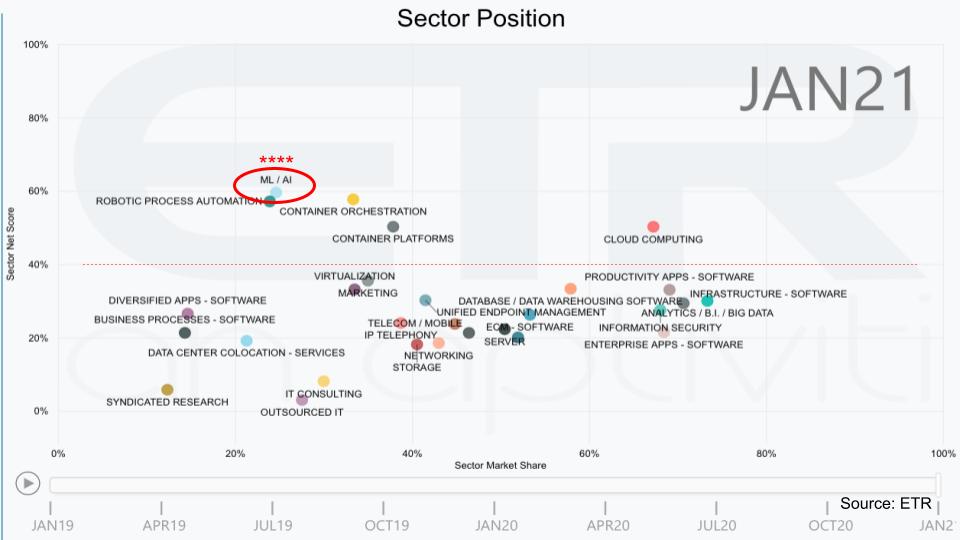

Arm is betting on AI and machine learning, as are many others, and the chart bel0w shows why.

The above graphic shows Enterprise Technology Research spending data from more than 1,200 respondents. Note that ML/AI gets the top spot on the vertical axis, which is Net Score – a measure of spending velocity. The horizontal axis is Market Share or presence in the data set. We give this sector four stars to signify its consistent lead in the survey data each quarter.

So improving on specific machine learning functionality in its architecture is a pretty safe bet by Arm.

Security is front and center

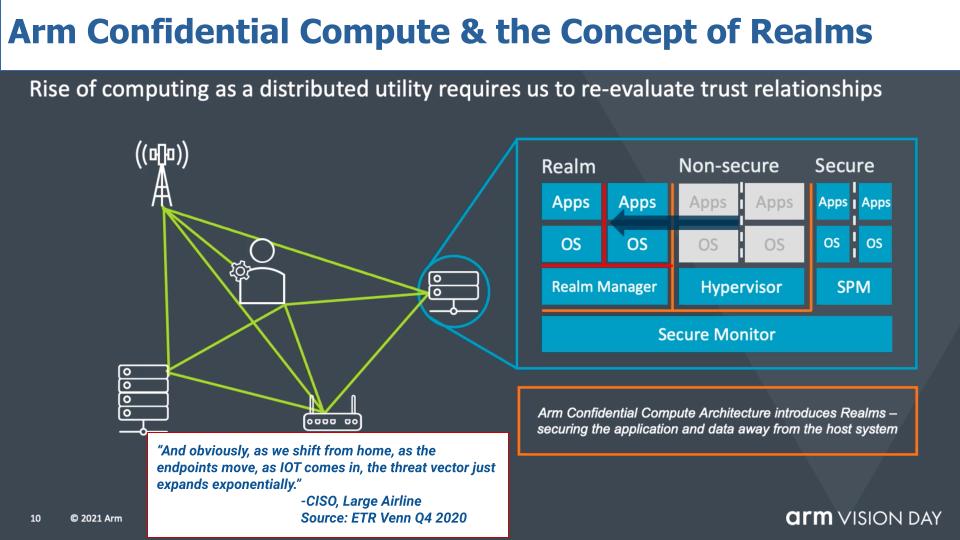

At its Vision Day, Arm talked about Confidential Compute Architecture and Realms.

Note the lefthand side showing data traveling all over and different use cases — and the call-out from the chief information security officer at a large public airline in an ETR Venn roundtable noting that the shifting endpoints increase the threat vectors.

Arm said something at its announcement that really resonated. Paraphrasing Arm’s commentary, today there is too much trust on the operating system and hypervisor that run applications. And their broad access to data creates exposures and threats from hackers. Arm’s concept of Realms as shown in the righthand side of the chart underscores the company’s strategy to remove the assumption that privileged software such as the hypervisor needs to be able to see the data. So by creating Realms in a virtualized, multitenant environment, data can be more protected from memory leaks – a major opportunity for hackers.

This is an elegant concept and a way for the system to isolate a tenant’s data from other users.

From the community: Intel didn’t miss mobile, it missed smartphones

We want to share some feedback from our last post summarizing our thoughts on Intel.

A tech exec from Citi pointed out that Intel really didn’t miss mobile – it missed smartphones. Although that’s a minor distinction it’s important to recognize. Intel facilitated WiFi with Centrino under the direction of CEO Paul Otellini – who was not an engineer but a marketing person by background. Ironically, Intel’s work in WiFi connectivity, designed to make laptops more useful leveraging hotspots in airports and coffee shops, enabled the smartphone revolution. Maybe that makes the smartphone miss by Intel all that more egregious because its head was buried so deep into PCs that it couldn’t see the future.

The other piece of feedback we received related to our IBM scenario and our three-way joint venture prediction bringing together Intel, IBM and Samsung.

The roles of IBM, Samsung, GlobalFoundries and the US government

Remember we said that IBM, with Power 10, has the best technology in terms of disaggregating compute from memory and sharing memory in a pool across different processor types. We’ll come back to that in a moment.

IBM, when it restructured its microelectronics business under CEO Ginni Rometty, catalyzed a partnership with GlobalFoundries Inc., which took over IBM’s semiconductor manufacturing plant in East Fishkill, New York. We believe this exit from a vertically integrated IBM was actually architected by current IBM CEO Arvind Krishna. GlobalFoundries, by the way, announced plans to sell off this plant in 2019 – the plan just didn’t pan out.

For context, GlobalFoundies was created in 2009 when Advanced Micro Devices Inc. got out of the business of manufacturing its own chips. In 2009 it broke ground on a new fab in Malta, New York, outside Albany. Malta would be where GlobalFoundries would produce some of its most advanced technologies, including eventually 7nm products.

The inset picture above shows the GF facility in Malta. AMD and IBM were committed to have their 7nm chips built by GlobalFoundries, but it backed away from 7nm, forcing IBM and AMD to look elsewhere for the latest and greatest technology. For a decade or more, Samsung, IBM and GlobalFoundries have been collaborating on a common design spec for advanced technologies.

But GlobalFoundries was losing money and its private backers were likely eager to recoup some of the $21 billion invested in fabs over the last several years. GlobalFoundries CEO Tom Caulfield has signaled an impending IPO. This all has caused a bit of a rift between the companies and leaves a hole with respect to the original vision of the Malta factory. It also leaves the United States in a weaker position relative to China.

Intel, IBM and the US government

For its part, Intel has great FinFet technology. FinFet goes beyond CMOS – you old mainframes will remember when IBM burned the boat on ECL and moved to CMOS — well, this is the next generation beyond and could give Intel a leg up on AMD’s Chiplet IP, especially as it relates to latency. And there could be some benefits for IBM.

Now while Krishna was the face of the Intel announcement and clearly has deep knowledge of IBM’s semiconductor strategy, we think Dario Gil is a key player in the mix. He’s the senior vice president and director of IBM Research, the part of IBM that was mentioned extensively in Intel’s announcement. He’s also is in a position to effect some knowledge sharing with Intel – possibly as it relates to disaggregated architectures.

Why would IBM do that? Well, it wants to compete more effectively with VMware, which has done a great job leveraging x86 — and that’s the biggest competitor to OpenShift. So Krishna needs Intel chips to execute on his cloud strategy because almost all of IBM customers are running apps on x86.

Where it gets really interesting is that New York Sen. Chuck Schumer is keen on building up an alternative to Silicon Valley in New York, known as Silicon Alley.

So is it possible that Intel, which has great process technology, with the U.S. government and IBM and Samsung could make a play for the New York foundry as part of its trusted foundry strategy and reshuffle the deck in Albany?

Sounds like “Game of Thrones.”

Volume remains the linchpin for foundry

There’s one more piece to this puzzle. TSMC has been so consumed servicing Apple for 5nm and eventually 4nm that it has dropped the ball on some of its other customers, namely Nvidia Corp. Remember, long-term competitiveness and cost reductions come down to volume. And we think Intel can’t get to volume without Arm.

Maybe the JV strategy we laid out is a stretch and Samsung may not be willing to play ball given its huge investments in South Korea – although we think that’s still a viable scenario. But if Intel can actually become a trusted foundry with the help of IBM and the U.S. government, maybe it can compete on volume by attracting some disaffected TSMC customers.

How would that work? Let’s say that Nvidia isn’t too happy with TSMC because it has to get in line behind Apple. Why wouldn’t Nvidia entertain Intel’s foundry as a second source? What about AWS, Google LLC and Facebook Inc.? Maybe this is a way to placate the U.S. government and call off the antitrust dogs: Give Intel foundry our business to secure America’s semiconductor leadership and perhaps the U.S. government is less contentious. And Microsoft, even though it’s not getting as much antitrust scrutiny, would likely be happy to play ball as well.

And why wouldn’t Apple want to have an on shore source of advanced technology supply. Gelsinger is just the person to pull something like this off because he’ll do well with the public policy folks.

Would this give Intel a competitive volume posture? Yes it would. For sure if it can gain the trust of these companies, the volume would be there.

As we’ve said, currently this is a long shot and will take years to play out. But the dots are connecting in this scenario and the stakes are exceedingly high.

Intel is in a fight for its life – and a nation’s competitiveness

Make no mistake, the stakes are higher than they’ve ever been for Intel because it transcends survival for a company. We’re talking the survival of an industry and a nation’s competitiveness.

As we emphasized with the Clay Christensen steel industry example, the threat from China cannot be overstated. And a key to long-term competitiveness absolutely lies in volume manufacturing.

Both Arm and TSMC have responded to Intel’s moves. Nvidia’s acquisition of Arm remains precarious as regulators and competitors object to the union, but if Nvidia pulls it off, Arm gets even stronger.

Arm announced its intentions to go beyond SoC, keeping pace with Intel, albeit with a purely outsourced strategy. Intel must, and we think will, maintain its high-end position in the market, but Arm will continue to gain footholds in the enterprise.

Intel’s big differentiator will be its Integrated Device Manufacturing or IDM strategy. Vertical integration is a long game and brings both quality and cost advantages. But without volume, Intel will not be able to compete on cost and literally could go bankrupt trying.

As such, this puts major pressure on Intel to successfully execute on its foundry strategy, which remains a high-risk/high-return venture. The role of the U.S. government will be to reduce that risk and increase the probability of Intel’s survival and the continued leadership of the country’s semiconductor industry.

Keep in touch

Remember these episodes are all available as podcasts wherever you listen. Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

Image: Suttipun

Since you’re here …

Show your support for our mission with our one-click subscription to our YouTube channel (below). The more subscribers we have, the more YouTube will suggest relevant enterprise and emerging technology content to you. Thanks!

Support our mission: >>>>>> SUBSCRIBE NOW >>>>>> to our YouTube channel.

… We’d also like to tell you about our mission and how you can help us fulfill it. SiliconANGLE Media Inc.’s business model is based on the intrinsic value of the content, not advertising. Unlike many online publications, we don’t have a paywall or run banner advertising, because we want to keep our journalism open, without influence or the need to chase traffic.The journalism, reporting and commentary on SiliconANGLE — along with live, unscripted video from our Silicon Valley studio and globe-trotting video teams at theCUBE — take a lot of hard work, time and money. Keeping the quality high requires the support of sponsors who are aligned with our vision of ad-free journalism content.

If you like the reporting, video interviews and other ad-free content here, please take a moment to check out a sample of the video content supported by our sponsors, tweet your support, and keep coming back to SiliconANGLE.

April 04, 2021 at 12:02AM

https://ift.tt/3uypasr

Chip industry battle royal: Arm throws down the gauntlet at Intel's feet - SiliconANGLE News

https://ift.tt/2YXg8Ic

Intel

No comments:

Post a Comment