Thus far, I'd have to say that the Q2 earnings season has exceeded expectations. It's true that the vast majority of stocks came into the quarter with lowered expectations being placed on them, and therefore, while we're seeing a lot of top and bottom line beats, the fact of the matter is, those companies are clearing very low bars and oftentimes posting significant negative y/y growth. However, the market appears to be content to ignore short-term fundamental data and, instead, focus on the potential for a turnaround in 2021. As I've said before, many companies appear to be trading on 2022 expectations right now, which is why I believe that we're in a bit of a bubble. But bubble or not, it's also true that we've seen solid share price movement overall and relatively few duds in the DGI space. One exception is Intel (INTC), which posted earnings a few weeks ago, stumbled, and has not recovered since. Being that INTC is one of the rare earnings-related dips that we've seen thus far during Q2, I wanted to take some time to analyze the stock to determine whether or not this is a dip worth buying.

Intel shares fell double digits after their Q2 report, in large part due to the fact that the company announced delays in its 7nm chip architecture. Intel also had issues with its 10nm transition and there are fears that the company is losing its edge. It's certainly true that Intel has allowed one of its primary competitors, Advanced Micro Devices (AMD), to make up ground in the race as the two companies constantly battle theoretical limitations set by Moore's Law. Heck, some would even argue that at this point in time, AMD has surpassed Intel due to the belief that it will not only win the race to 7nm architecture in the PC arena but dominate the space moving forward.

Personally, I'm never one to bet against the incumbent leader. Intel has been a blue-chip stock for some time now. In recent years, the company has used its strong brand name, cash flows, and marketing power to build significant size and scale in exciting industries outside of the PC space, where it originally made a name for itself. Intel's revenue stream now has exposure to the data center market, artificial intelligence, and automation, which are all long-term secular growth areas of the market that investors typically find attractive. And since that devastating Q2 report, that company has made exciting announcements regarding intranode enhancements in its 10nm chips via the SuperFin line. From a computing standpoint, it appears that Intel's 10nm chips offer very similar transitory density and performance metrics to other 7nm architectures from competitors. So, while the 7nm headline news was certainly disappointing, rational investors have to question the significance of the weakness that the company has experienced since.

Frankly put, reading analysis about the chip space is a bit mind-numbing. There is clearly a race to the bottom going on with regard to chip size, but other variables like processing power, energy efficiency, and software support make this competition much more complicated than simply seeing who is delivering the smallest-nanometer chips. What's more, it's clear to me that in the hardware space, there are "fanboys" on either side of the aisle with regard to Intel and AMD, and bias in reporting makes it difficult to know who is really in the lead in this race. When I attempt to broaden the scope to the competition going on in the other markets previously mentioned (data center/cloud, A.I., automation), the comparisons become even more muddled.

The one thing that is certain to me is that competition in the chip space is fierce. Yet, over the long term, I can't help but wonder whether or not it matters all that much. It appears as if secular tailwinds will create volume growth large enough to support multiple players in each market. I highly doubt that any of the chip spaces will be winner-take-all competitions. And with that in mind, I think it's less important to pick a side in the raging debates about who's the best chip name, but instead, make sure that you have high-quality exposure to the trends that matter and that you're accumulating shares at attractive valuations.

At the end of the day, to me, it's not so much the headlines surrounding product launches that matter so much as it is the underlying fundamentals of the companies themselves. Call this a cop-out, but to me, the most important aspect of any investment thesis boils down to quality and valuation. The market is oftentimes myopic with its focus on winners and losers in the present. To me, investors who pay too much attention to single product/architecture delays in the chip space and even short-term variations in market share are missing the forest for the trees. And since I'll be the first to admit that I am not a Silicon Valley whiz kid with regard to my knowledge of the incredible advancements going on in the semiconductor space, I'm more than happy to yield to the consensus of the professional analysts whose firms pay the big bucks to stay on top of this notably volatile industry.

I feel much more comfortable comparing fundamental data and relative valuation metrics amongst Intel and its peers than I do reading the tech-specs of its hardware and attempting to weigh such performance against fabrication potential, consumer demand, and, most notably, the geopolitical pressure that are currently being placed onto the semiconductor space. With that in mind, this piece will not be focused on the more speculative aspects of Intel's investment thesis right now, but instead, simply determining where fair value appears to lie based upon the company's history, its current fundamental data, and the consensus analyst estimate for its near-term future results.

Valuation

Valuations can vary immensely across the chip space. The highest quality growth stocks in the industry can trade with triple-digit P/E ratios (Nvidia (NVDA) comes to mind in that regard right now). However, many other blue chips oftentimes trade with P/E ratios closer to single digits due to the inherent disruption of the hardware space that Moore's Law puts onto the table. Right now, Intel trades for roughly 10x blended earnings, putting it towards the lower end of the spectrum with regard to comparisons to its large-cap peers.

Now, the multi-billion dollar question remains, is 10x fair?

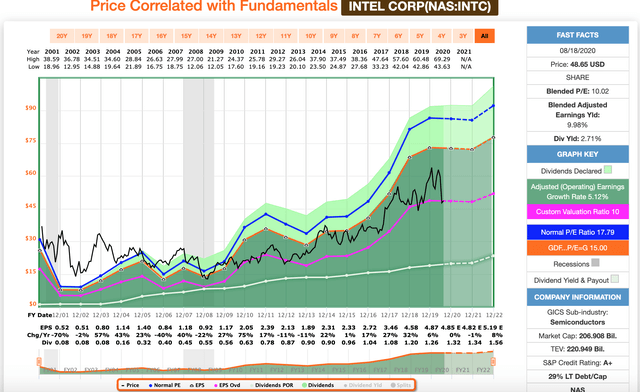

(Source: F.A.S.T. Graphs)

Intel's long-term average P/E ratio (looking back 20 years) is 17.8x. However, this period of time contains moments in the early 2000s where the stock was trading in the 40x-50x range, which inflates the average a bit.

Over the last 10 years, Intel's average P/E ratio is 12.65x. This is much closer to the current P/E ratio and in line with that low-double digit area that mature hardware names tend to trade in.

During the last 5 years, the company's average P/E ratio is 12.99x, so somewhat in-line with that 10-year average.

So, with this in mind, using historical data, I think it's fair to say that a 12x-13x multiple is about right now this stock.

With regard to the company's most recent results, we see that Intel's bottom line growth performance was amazing in 2016, 2017, and 2018; however, it has lagged in recent years. In 2020, EPS growth is expected to be flat. And in 2021, analysts are expecting another flat to -1% growth year. With this in mind, the present data is disappointing. However, if you take a step back and look at Intel's long-term EPS growth history, it's clear that the company operates on a somewhat cyclical basis, and periods of lackluster performance have traditionally been followed by strong growth upticks. Obviously, the past cannot be used to predict the future, but due to the combination of the trade war (which has had a significant impact on the tech space) and the COVID-19 pandemic which has negatively impacted capex in just about every industry on Earth, I think it's fair to say that macro concerns could have forced this name into a cyclical trough.

During the Q2 report, Intel's management was bullish on its ability to retake market share in the second half of 2020, and looking past the PC chip space, the company did appear to continue to make progress in the GPU space across multiple product segments (data center sales were up an impressive 43%). Since analysts are concerned that the 7nm story may no longer occur in 2021 for Intel, it appears that future growth estimates have been kicked down the road for another year. Right now, the consensus EPS growth estimate for 2022 is 8%. However, when I look at the company's 10x multiple in the present, it appears that much of the recently unearthed fears are now priced into the stock, providing patient investors an opportunity to accumulate shares at a valuation level that has long served as support for the company. (As you can see on the F.A.S.T. Graph above, I've highlighted the 10x threshold with a bright pink line, and the only time that the stock fell below that level during the last 20 years was during a management transition period in 2012.)

The Dividend

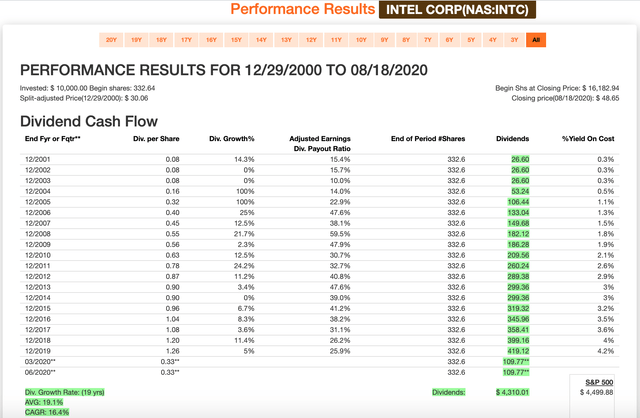

One of the benefits of buying Intel into weakness like this is that an investor locks in a higher than average yield on cost.

Shares current provide investors with a 2.7% yield. This certainly doesn't place Intel into the high yield area of the market, but it's well above the 1.69% yield provided by the S&P 500 currently and even higher above the yields currently provided by long-term U.S. treasury notes.

Historically, Intel's dividend growth has corresponded with its cyclical bottom line results. The stock does not have a long-term dividend growth streak (right now, its annual dividend growth streak sits at 6 years) because of the fact that dividend freezes are fairly common in the company's history. However, while management has shown a willingness to freeze dividend growth, they are not known for cutting the dividend. As you can see below, Intel has made it through the last 2 recessions without a dividend cut. What's more, while dividend growth has been bumpy over time, the long-term average dividend increase and dividend growth CAGR both sit at strong, double-digit rates. Moving forward, I expect the company's dividend growth to continue to be bumpy. This may upset certain dividend growth investors looking for more predictable annual passive income increases, but ultimately, I do believe that Intel's dividend is safe.

(Source: F.A.S.T. Graphs)

Right now, the forward EPS payout ratio is just 27.2%. With this in mind, I suspect that management will continue to raise the dividend through the projected 2020/21 earnings growth.

Also, with regard to capital allocation/shareholder returns, Intel just announced a massive $10 billion accelerated buyback program. It previously suspended buybacks back in March, so this is a positive step for the company, in my opinion. This sent the share pricing rising after-hours on Wednesday, and I can't help but wonder if this decisive action by management will result in a change in overall sentiment. It appears that I'm not the only one who thought the stock was attractively priced in the 10x range.

Conclusion

To summarize this piece, Intel appears to be cheap in the sub-$50 area. The stock appears to have found support in this $48 area (which isn't surprising due to how well the shares have held up in the 10x area far into the past).

I will say that due to cyclicality, this isn't a name that I feel comfortable going overweight into. While Intel's dividend has trended up nicely over time, the company doesn't necessarily generate reliably increasing income on an annual basis, which means that the stock does not perfectly fit my qualifications of a blue-chip DGI stock. However, I do think this is a name worth owning if you want exposure to the semiconductor space.

If you're underweight Intel and have been looking to add, there is certainly an argument to be made here for a wide margin of safety, and I think that long-term investors buying here into weakness stand to benefit from an attractive risk/reward.

I was happy to see the buyback announcement. Assuming that the stock doesn't run too far on the news, I will likely end up adding to my personal position in the near term because of the low valuation combined with the confidence that management is showing.

This article was previously published for subscribers to The Dividend Kings.

- Access to our four model portfolios

- 30 exclusive articles per month

- Our upcoming weekly podcast

- 20% discount to F.A.S.T Graphs

- real-time chatroom support

- exclusive access to two preferred stock portfolios

- exclusive updates to David Fish's (now run by Justin Law) Dividend Champion list

- exclusive weekly updates to all my retirement portfolio trades

- Our "Learn How To Invest Better" Library

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.

Disclosure: I am/we are long INTC, NVDA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The Link LonkAugust 26, 2020 at 05:27PM

https://ift.tt/2D0TWVw

Intel Appears To Offer A Wide Margin Of Safety At Just 10x Earnings - Seeking Alpha

https://ift.tt/2YXg8Ic

Intel

No comments:

Post a Comment