Intel (INTC) is expected to announce its Q3 FY20 results in two weeks on October 22. Investors would be keen to see where its revenues for the period come in at, given the heightened global economic uncertainty of late. But in addition to tracking its headline revenue figure, readers and investors may also want to track its bifurcated financial performance, along with its ASP and shipment growth figures. These items are likely to have a bearing on where the chipzilla's shares head next. Let's take a closer look at it all.

(Image source: Intel)

Bifurcated Financials

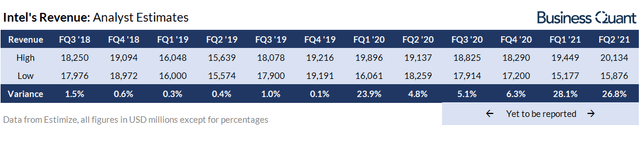

Let me start by saying that analysts are forecasting Intel's Q3 revenues to come in between $17.91 billion and $18.83 billion. The average estimate equates to $18.22 billion, which would mark a year over year sales decline of about 5%. This figure isn't too far off from Intel management's own guidance of about $18.2 billion that was announced during its last earnings call back in July. This convergence of analyst estimates and management's guidance suggests that the two parties are on the same page when it comes to assessing Intel's near-term prospects.

Besides, an interesting trend is coming to light. The range of high and low-end analyst estimates pertaining to Intel's future revenues has considerably narrowed down since Q1. Although the variance is yet to reach pre-COVID-19 levels, the shrinking figure suggests that analysts are starting to agree with each other when it comes to Intel's future prospects.

(Table by author with data from Estimize)

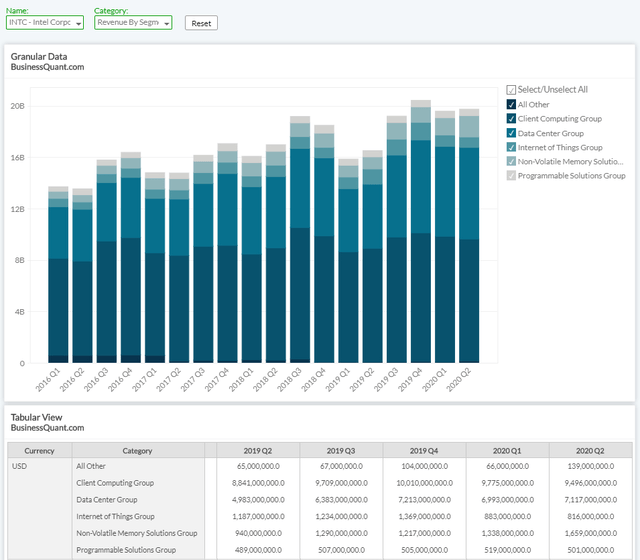

Having said that, tracking Intel's segregated financial results would shed light on how well each of its segments performed and which of them dragged the company's overall financials lower. For the uninitiated, Intel has five reporting segments out of which its Data Center Group and Client Computing Group are its largest in terms of sales, accounting for over 36% and 48% of its total revenue in the last quarter respectively.

(Source: BusinessQuant.com)

The two mentioned segments have material levers at play of late which can create a notable fluctuation in the chipzilla's Q3 revenue, given their sizable sales contribution towards the overall top-line. For starters, channel checks by Digitimes reveal that data center shipments may shrink by 5.6% in Q3 on a sequential basis. The reason for the decline is said to be the high-base figure of Q2 and also the cooling down demand for cloud, data center and enterprise servers. So, going by this report, we can expect Intel's data center group revenues to remain flat or even shrink in its upcoming quarterly results.

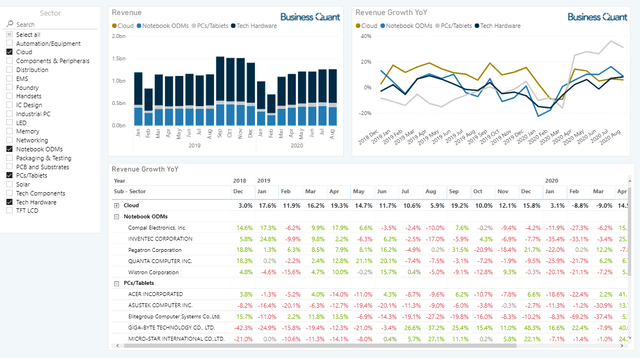

At the same time, I personally expect Intel's client computing group revenues to grow sequentially and on a year over year basis. The basis of my thesis lies in the strong monthly sales performance of some of the consumer-centric PC and notebook ODMs (or Original Design Manufacturers) in July and August.

(Source: Business Quant)

Most of the mentioned firms in the table above make platform products for Intel and/or AMD (AMD), with their portfolios spanning products such as laptops, desktops, motherboards and other computing peripherals, and so their monthly revenues can be considered as a leading indicator about consumer and channel demand trends for PCs and notebooks.

Many readers and commenters are fearing that the demand for PC and notebooks would temporarily wane as customers would want to defer their purchases in anticipation for AMD's upcoming Zen 3-based chips - due for release this month. But since the bulk of the above-mentioned firms registered robust sales growth in each of the last two months, I contend that the channel demand for PC and notebook continues to remain strong. So, my expectation regarding Intel's client computing group revenues growing year over year is more of a guesstimate that's based on general trends prevalent within the PC and notebook channel, rather than it being based on a sophisticated mathematical model.

Another growth lever would be capitalizing on AMD's difficulties. The rumor mill suggests that AMD was facing a supply shortfall of OEM-grade APU chips during the third quarter. This was later confirmed by technology enthusiasts (such as here) but they couldn't tie the dots together and instead started peddling their own speculative narratives - such as Intel bribing OEMs and AMD being secretive about its flaws.

(Source: YouTube comments below this video)

But I personally think that AMD's supply shortfall merely encouraged ODMs and OEMs to opt for Intel in a bid to secure a stable supply of microprocessors. So listen in on Intel's management's confirmation around the same and how much exactly did this supply shortage benefit the chipzilla during their Q3 call.

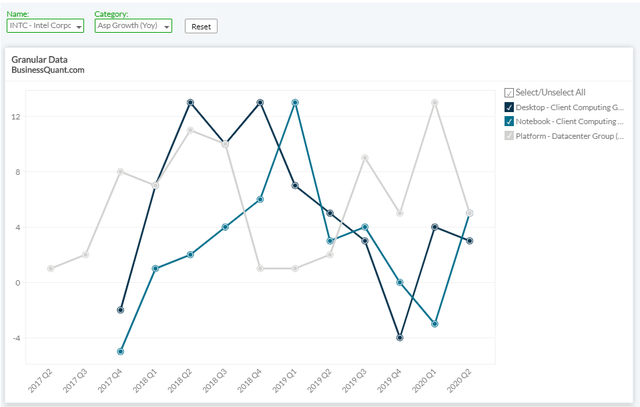

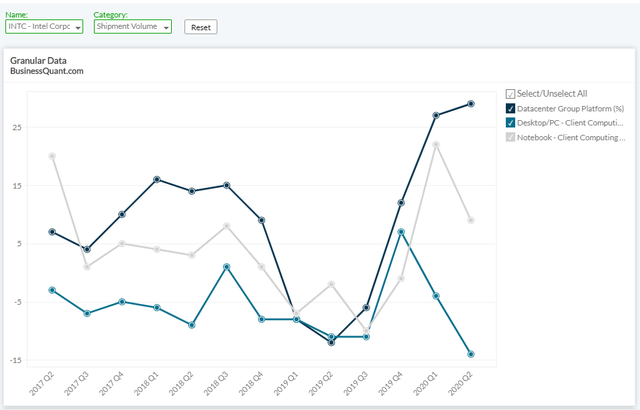

ASP and Shipment Growth

Next, bifurcated revenues alone won't reveal the entire picture. There are several combinations by which a company can boost its revenues, and arguably not all are sustainable. Some of these scenarios are:

- Flat average selling prices (or ASPs) but registering a growth in shipments, or;

- Growth in ASPs but flat shipment volume, or;

- Shrinking ASPs at the expense of margin profile, to materially grow revenues, or;

- Dramatically hike the ASPs to offset a sharp drop in shipments, or;

- Growth in both ASPs and shipments.

Ideally, shareholders would want their company to experience an overall growth phase as mentioned in the fifth bullet - healthy growth in both ASPs and shipment volumes. It indicates an improvement in competitive positioning and pricing power. But things aren't so linear and simple for Intel since its smaller rival, AMD, has been giving it a fierce fight and experiencing commercial success with its Zen-based SKUs. So, readers must also monitor Intel's ASPs and shipment growth figures in its upcoming earnings report, to gain clarity on its state of operations, competitive positioning and growth prospects.

The following charts should put things in perspective.

(Intel's ASP growth rates, Source: BusinessQuant.com)

(Intel's Shipment growth rates, Source: BusinessQuant.com)

If AMD is truly experiencing a Ryzen APU supply crunch, then OEMs such as Dell, Lenovo and HP may have very well opted for Intel chips during the quarter in order to source a stable supply of x86 microprocessors. From a results standpoint, this could reflect as an increase in Intel's notebook shipments and possibly also in its notebook ASPs due to reduced market competition. But the absence of any such fluctuation in its Q3 earnings report would mean that AMD's supply shortages were non-existent or exaggerated.

Similarly, if data center shipments actually contracted during Q3, as the Digitimes report suggests, then Intel should ideally register a decline in its server shipments as well. But the absence of any fluctuation on this front would suggest that the Digitimes report wasn't very accurate.

Lastly, Intel has registered a contraction in its desktop platform shipments in the last two quarters straight. We don't have any comparables for this figure as AMD doesn't disclose desktop-specific shipment growth numbers. But the back to back decline in Intel's desktop shipments fuels speculation that it's no longer competitive and that it's losing ground to its smaller rival AMD.

Final Thoughts

There are several variables around Intel's near-term prospects for the time being at least. So, I would recommend that readers dig deeper into Intel's financial results and monitor its bifurcated financials, its ASP and shipment growth figures. These items will shed light on the chipzilla's financial and operating performance and are likely going to dictate where its shares head next. Good Luck!

Author's Note: I'll be writing another report on Intel later this month, you can stay updated by clicking the "Follow" button at the top of this page. Thanks!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The Link LonkOctober 08, 2020 at 08:00PM

https://ift.tt/2SCYwxr

Intel: The Moment Of Truth - Seeking Alpha

https://ift.tt/2YXg8Ic

Intel

No comments:

Post a Comment